A Real Time Stock Market Feed

In this tutorial, we'll walk through building a real-time stock market data feed and streaming that data into a simplified KDB/Q Tick architecture. We'll use Python, specifically the yfinance library, to fetch live market data from Yahoo Finance, and then publish it to a custom KDB/Q Tickerplant (TP), which will forward the data to a Real-Time Database (RDB). We'll use the qpython library to connect our Feedhandler to the Tickerplant, enabling us to stream real-time data for further processing.

While this setup has been simplified for educational purposes, it can be easily adapted to resemble a more production-ready environment.

Who is this tutorial for?

This tutorial is designed for anyone interested in building a real-time stock market data application. Whether you're a KDB/Q developer curious about the technical implementation, or a quantitative developer or researcher looking to set up a live data feed for analytics and strategy development, this guide is for you.

Prerequisites

To get the most out of this tutorial, you should have a solid understanding of the KDB/Q Tick architecture. If you're unfamiliar with it, please check out this dedicated blog post. Additionally, a good understanding of how the Tickerplant works will be helpful, and I recommend reviewing my two in-depth tutorials that walk through the Plain Vanilla Tickerplant code line by line, which you can find here.

What’s in It for You: Skills You’ll Master in This Tutorial

In this tutorial, you’ll learn how to build a simple yet powerful real-time stock data streaming application. Along the way, you’ll get hands-on with the plain vanilla Tick architecture and deepen your understanding of key KDB/Q concepts like dictionaries, tables, attributes, and interprocess communication. You’ll also explore how to work with various Python libraries and establish seamless connectivity between Python and KDB/Q.

Under the Hood: The Minimalist Tech Stack Powering It All

The tech stack behind this application is intentionally lightweight and focused, using just two core technologies.

On the Python side, we use:

yfinanceto fetch real-time stock market data from Yahoo Financeqpythonto connect Python to KDB/Q and stream data in real time

And of course, the backbone of the setup is KDB/Q. We’ll build a streamlined Tickerplant and a real-time database using the simple tick library provided by KX.

The Setup

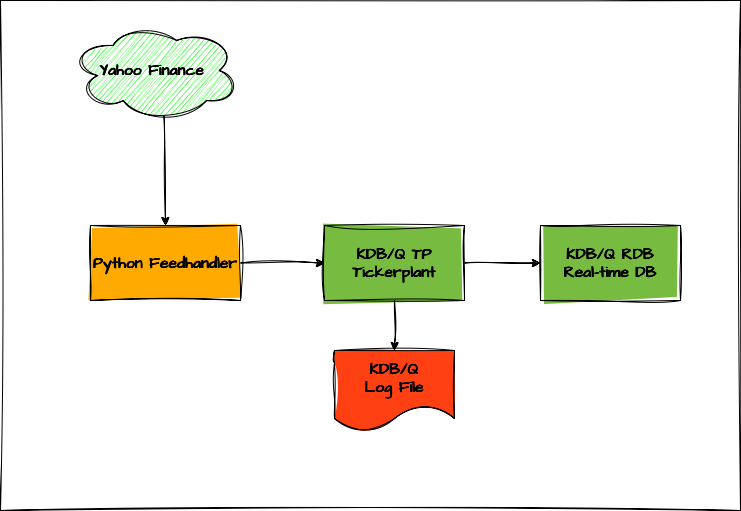

The architecture of this application is fairly simple and consists of three main components:

- A Python-based Feedhandler that retrieves real-time stock data from Yahoo Finance and streams it to a KDB/Q Tickerplant

- A custom KDB/Q Tickerplant that ingests the data and forwards it to the Real-Time Database (RDB)

- A Real-Time Database that stores all intraday data in memory

In the following section, we’ll take a closer look at each component of the setup, highlighting their key features and roles.

Feedhandler

As expected, the Python script for the Feedhandler is by far the longest, bringing to life the common joke: “For every line of KDB/Q, you’ll need at least 10 in a mainstream language like Python or Java.”. Having worked almost exclusively with KDB/Q over the past decade, my Python skills are admittedly non existent and my friend Claude had to save the day. While LLMs still struggle to make sense of KDB/Q, thankfully they’re fluent in Python. After a few back-and-forths, Claude managed to crank out a fully functioning Feedhandler.

The Feedhandler uses the yfinance library to pull real-time stock market data from Yahoo Finance. You can specify which tickers you'd like to track by listing them in a CSV file, which the script reads on startup.

Due to rate limits imposed by Yahoo Finance, the script fetches data at 30-second intervals by default. This interval is configurable via a command-line argument or an environment variable.

To stream data from Python to KDB/Q, we use the qpython library. While PyKX would be a more modern alternative, it’s currently only available under a KX Insights license, so for broader accessibility, we’ve opted for qpython. Since the library is a bit dated, there’s a minor workaround needed when working with numpy, but otherwise, the script is fairly straightforward and easy to follow.

tickers.csv: Your Command Center for Stock Selection

To keep our application flexible and easy to configure, we use a simple CSV file, tickers.csv, to define the list of stocks we want to track. Just add the relevant stock tickers to this file, and the Feedhandler will take it from there. This approach lets you quickly adjust your data feed without touching the code.

Table Schema and sym.q File

Before we dive into the Tickerplant code, let’s take a moment to review the table schema for the data we’re capturing. As you might recall (especially if you’ve read my Tickerplant walkthrough), table schemas are stored in the sym.q file, which the Tickerplant loads during initialization.

For this exercise, we’ve defined the schema as follows:

time: timestamp recorded by the Tickerplantsym: ticker symbol of the stockfeedHandlerTime: timestamp from the Feedhandleropen, high, low, close: OHLC price datavolume: trading volumebid, ask: bid and ask pricesbidSize, askSize: sizes at the bid and ask

A quick note: we're capturing both the Tickerplant and Feedhandler timestamps. While this might not be critical in our educational example, it’s a best practice in real-time systems—especially when you want to measure latency between data ingestion points. To reinforce good KDB/Q practices, we apply the sorted s attribute to the time column and the grouped attribute to the sym column. If you're not familiar with attributes, or could use a refresher on how they work and why they matter, check out my dedicated post here

stocks:([] time:`s#`timestamp$(); `g#sym:`symbol$(); feedHandlerTime:`timestamp$(); open: `float$(); high:`float$(); low:`float$(); close:`float$(); volume:`int$(); bid:`float$(); ask:`float$(); bidSize:`int$(); askSize:`int$() )

Tickerplant (TP)

The Tickerplant used in this setup is an even more lightweight version than the one featured in our Plain Vanilla Tick Setup walkthrough. Since we're only fetching data every 30 seconds, there's no need to process each tick individually, instead, we'll run the Tickerplant in batch mode, publishing data on a pre-defined interval.

We've also made a few tweaks to the .u.upd function to accommodate the structure of the incoming data. To understand how it works, we'll set a breakpoint in .u.upd, inspect the incoming messages, and step through the logic together.

The section we're focusing on is shown below. We’ll start the Tickerplant without specifying a batch interval, which means the execution path will hit the .u.upd function defined here. At this point, we can set a breakpoint using 'break to pause execution and inspect the incoming data when the function is triggered.

if[not system"t";system"t 1000";

.z.ts:{ts .z.D};

upd:{[t;x]

ts"d"$a:.z.P;

'break;

if[not -16=type first first x;a:"n"$a;x:$[0>type first x;a,x;(enlist(count first x)#a),x]];

f:key flip value t;pub[`$t;$[0>type first x;enlist f!x;update `$sym,"P"$feedHandlerTimer from flip f!flip x:a,'x]];if[l;l enlist (`upd;t;x);i+:1];}];

To trigger a breakpoint, you can use the signal operator ' with any custom error message and are not limited to using break as I did.

After saving our changes, we launch the Tickerplant with the command:

qq tick.q sym . -p 5010

Once the Tickerplant is up and running, be sure to set the \e flag to 1 (true). This enables error trapping mode, allowing us to inspect the internal state and debug more effectively.

alexanderunterrainer@Mac:~/repos/yfinData|⇒ qq tick.q sym . -p 5010

KDB+ 4.1 2025.02.18 Copyright (C) 1993-2025 Kx Systems

m64/ 8(24)core 24576MB alexanderunterrainer mac 192.168.1.177 EXPIRE 2026.03.11 KDB PLUS PERSONAL #5024911

q).u.upd

{[t;x]

ts"d"$a:.z.P;

'break;

if[not -16=type first first x;a:"n"$a;x:$[0>type first x;a,x;(enlist(count first x)#a),x]];

f:key flip value t;pub[`$t;$[0>type first x;enlist f!x;update `$sym,"P"$feedHandlerTimer from flip f!flip x:a,'x]];if[l;l enlist (`upd;t;x);i+:1];}

q)\e 1

q)\e

1i

q)

Now let’s fire up the Python Feedhandler and watch the magic happen as our code "breaks" precisely where we intended.

q)'break

[0] /Users/alexanderunterrainer/repos/yfinData/tick.q:45: .u.upd:

ts"d"$a:.z.P;

'break;

^

if[not -16=type first first x;a:"n"$a;x:$[0>type first x;a,x;(enlist(count first x)#a),x]];

q.u))

Based on our function definition, we know that .u.upd accepts two arguments: t, the table name, and x, the data to be streamed to all real-time subscribers. Let’s take a closer look at the data being received.

q)'break

[0] /Users/alexanderunterrainer/repos/yfinData/tick.q:45: .u.upd:

ts"d"$a:.z.P;

'break;

^

if[not -16=type first first x;a:"n"$a;x:$[0>type first x;a,x;(enlist(count first x)#a),x]];

q.u))t

"stocks"

q.u))x

"AMZN" "2025.05.18D10:22:20.279" 206.85 206.85 204.37 205.59 43072700 205.49 205.77 3 3

"GOOGL" "2025.05.18D10:22:20.279" 167.73 169.35 165.62 166.19 42650100 166.14 166.26 7 7

"HD" "2025.05.18D10:22:20.279" 380.23 381.17 378.15 380.78 3127300 377.36 379.6 8 8

"JNJ" "2025.05.18D10:22:20.279" 149.67 151.5 149.22 151.33 8046000 151.1 151.1 8 9

"JPM" "2025.05.18D10:22:20.279" 267.5 268.46 264.71 267.56 8925900 264.5 266.01 12 8

"MA" "2025.05.18D10:22:20.279" 580.43 584.29 580.43 583.28 2225400 578.78 584.29 11 8

"META" "2025.05.18D10:22:20.279" 637.96 640.44 626.15 640.34 18405900 639.55 640.95 1 1

"MSFT" "2025.05.18D10:22:20.279" 452.05 454.36 448.73 454.27 23803400 443.32 454.45 1 2

"NVDA" "2025.05.18D10:22:20.279" 136.22 136.35 133.46 135.4 222651500 126.78 137f 1 2

"PG" "2025.05.18D10:22:20.279" 162.65 163.43 161.85 163.28 7100200 163.17 163.49 9 8

"TSLA" "2025.05.18D10:22:20.279" 346.24 351.62 342.33 349.98 93811800 328.7 363.64 1 1

"UNH" "2025.05.18D10:22:20.279" 279.29 294.49 269.14 291.91 70637700 287.57 287.7 8 14

"V" "2025.05.18D10:22:20.279" 362.95 366.19 360.89 365.12 5836500 363.55 365.25 8 9

"WMT" "2025.05.18D10:22:20.279" 96.14 99.19 96f 98.24 33708300 96.51 97.78 13 22

q.u))type x

0h

q.u))type first x

0h

q.u))first x

"AMZN"

"2025.05.18D10:22:20.279"

206.85

206.85

204.37

205.59

43072700

205.49

205.77

3

3

q.u))

As shown above, the data sent by the Feedhandler is a mixed list of mixed lists. We can verify this by applying the type operator to the entire dataset as well as to its first element, both return 0h, indicating a mixed list.

Since our table schema includes a Tickerplant timestamp, the first step is to prepend this timestamp to each row of incoming data. Here's how we can do that:

From the first line of our .u.upd function, we know that the current timestamp, retrieved using .z.P, s stored in the variable a. We can now use this variable to append the timestamp to each record in the mixed list. To do this, we use the each-both ' iterator along with the concatenate operator ,. Thanks to atomic extension, and the fact that we’re adding the same timestamp to every record, we can simply use a single timestamp atom, rather than generating a list of timestamps matching the length of our dataset.

q.u))a

2025.05.18D10:22:23.548140000

q.u))a,'x

2025.05.18D10:22:23.548140000 "AMZN" "2025.05.18D10:22:20.279" 206.85 206.85 204.37 205.59 43072700 205.49 205.77 3 3

2025.05.18D10:22:23.548140000 "GOOGL" "2025.05.18D10:22:20.279" 167.73 169.35 165.62 166.19 42650100 166.14 166.26 7 7

2025.05.18D10:22:23.548140000 "HD" "2025.05.18D10:22:20.279" 380.23 381.17 378.15 380.78 3127300 377.36 379.6 8 8

2025.05.18D10:22:23.548140000 "JNJ" "2025.05.18D10:22:20.279" 149.67 151.5 149.22 151.33 8046000 151.1 151.1 8 9

2025.05.18D10:22:23.548140000 "JPM" "2025.05.18D10:22:20.279" 267.5 268.46 264.71 267.56 8925900 264.5 266.01 12 8

2025.05.18D10:22:23.548140000 "MA" "2025.05.18D10:22:20.279" 580.43 584.29 580.43 583.28 2225400 578.78 584.29 11 8

2025.05.18D10:22:23.548140000 "META" "2025.05.18D10:22:20.279" 637.96 640.44 626.15 640.34 18405900 639.55 640.95 1 1

2025.05.18D10:22:23.548140000 "MSFT" "2025.05.18D10:22:20.279" 452.05 454.36 448.73 454.27 23803400 443.32 454.45 1 2

2025.05.18D10:22:23.548140000 "NVDA" "2025.05.18D10:22:20.279" 136.22 136.35 133.46 135.4 222651500 126.78 137f 1 2

2025.05.18D10:22:23.548140000 "PG" "2025.05.18D10:22:20.279" 162.65 163.43 161.85 163.28 7100200 163.17 163.49 9 8

2025.05.18D10:22:23.548140000 "TSLA" "2025.05.18D10:22:20.279" 346.24 351.62 342.33 349.98 93811800 328.7 363.64 1 1

2025.05.18D10:22:23.548140000 "UNH" "2025.05.18D10:22:20.279" 279.29 294.49 269.14 291.91 70637700 287.57 287.7 8 14

2025.05.18D10:22:23.548140000 "V" "2025.05.18D10:22:20.279" 362.95 366.19 360.89 365.12 5836500 363.55 365.25 8 9

2025.05.18D10:22:23.548140000 "WMT" "2025.05.18D10:22:20.279" 96.14 99.19 96f 98.24 33708300 96.51 97.78 13 22

With all the necessary data in place, the final step is to transform it into a proper KDB/Q table:

We start by transposing the dataset using the flip operator. This restructures the mixed list so that each inner list now represents a column: the first list contains the Tickerplant timestamps, the second is a list of ticker symbols (as character strings), the third holds the Feedhandler timestamps, followed by lists of price data, volume, bid/ask prices, and sizes.

Next, we use this transposed structure to build a column dictionary, aligning each list with the corresponding column name from our stock table schema defined in sym.q, which the Tickerplant loads during initialization. From there, it’s simple: a KDB/Q table is just a flipped column dictionary. So all that remains is one final flip to produce the fully structured stock data table.

If you need a refresher on KDB/Q dictionaries or tables, and how to create, update, or manipulate them, check out my post here

q.u))flip a,'x

2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000..

"AMZN" "GOOGL" "HD" "JNJ" "JPM" "MA" "META" "MSFT" ..

"2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" ..

206.85 167.73 380.23 149.67 267.5 580.43 637.96 452.05 ..

206.85 169.35 381.17 151.5 268.46 584.29 640.44 454.36 ..

204.37 165.62 378.15 149.22 264.71 580.43 626.15 448.73 ..

205.59 166.19 380.78 151.33 267.56 583.28 640.34 454.27 ..

43072700 42650100 3127300 8046000 8925900 2225400 18405900 23803400 ..

205.49 166.14 377.36 151.1 264.5 578.78 639.55 443.32 ..

205.77 166.26 379.6 151.1 266.01 584.29 640.95 454.45 ..

3 7 8 8 12 11 1 1 ..

3 7 8 9 8 8 1 2 ..

q.u))`time`sym`feedHandlerTime`open`high`low`close`volume`bid`ask`bidSize`askSize!flip a,'x

time | 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D10:22:23.548140000 2025.05.18D1..

sym | "AMZN" "GOOGL" "HD" "JNJ" "JPM" "MA" "META" "MSFT" ..

feedHandlerTime| "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D10:22:20.279" "2025.05.18D..

open | 206.85 167.73 380.23 149.67 267.5 580.43 637.96 452.05 ..

high | 206.85 169.35 381.17 151.5 268.46 584.29 640.44 454.36 ..

low | 204.37 165.62 378.15 149.22 264.71 580.43 626.15 448.73 ..

close | 205.59 166.19 380.78 151.33 267.56 583.28 640.34 454.27 ..

volume | 43072700 42650100 3127300 8046000 8925900 2225400 18405900 23803400 ..

bid | 205.49 166.14 377.36 151.1 264.5 578.78 639.55 443.32 ..

ask | 205.77 166.26 379.6 151.1 266.01 584.29 640.95 454.45 ..

bidSize | 3 7 8 8 12 11 1 1 ..

askSize | 3 7 8 9 8 8 1 2 ..

q.u))flip `time`sym`feedHandlerTime`open`high`low`close`volume`bid`ask`bidSize`askSize!flip a,'x

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

-----------------------------------------------------------------------------------------------------------------------------------

2025.05.18D10:22:23.548140000 "AMZN" "2025.05.18D10:22:20.279" 206.85 206.85 204.37 205.59 43072700 205.49 205.77 3 3

2025.05.18D10:22:23.548140000 "GOOGL" "2025.05.18D10:22:20.279" 167.73 169.35 165.62 166.19 42650100 166.14 166.26 7 7

2025.05.18D10:22:23.548140000 "HD" "2025.05.18D10:22:20.279" 380.23 381.17 378.15 380.78 3127300 377.36 379.6 8 8

2025.05.18D10:22:23.548140000 "JNJ" "2025.05.18D10:22:20.279" 149.67 151.5 149.22 151.33 8046000 151.1 151.1 8 9

2025.05.18D10:22:23.548140000 "JPM" "2025.05.18D10:22:20.279" 267.5 268.46 264.71 267.56 8925900 264.5 266.01 12 8

2025.05.18D10:22:23.548140000 "MA" "2025.05.18D10:22:20.279" 580.43 584.29 580.43 583.28 2225400 578.78 584.29 11 8

2025.05.18D10:22:23.548140000 "META" "2025.05.18D10:22:20.279" 637.96 640.44 626.15 640.34 18405900 639.55 640.95 1 1

2025.05.18D10:22:23.548140000 "MSFT" "2025.05.18D10:22:20.279" 452.05 454.36 448.73 454.27 23803400 443.32 454.45 1 2

2025.05.18D10:22:23.548140000 "NVDA" "2025.05.18D10:22:20.279" 136.22 136.35 133.46 135.4 222651500 126.78 137 1 2

2025.05.18D10:22:23.548140000 "PG" "2025.05.18D10:22:20.279" 162.65 163.43 161.85 163.28 7100200 163.17 163.49 9 8

2025.05.18D10:22:23.548140000 "TSLA" "2025.05.18D10:22:20.279" 346.24 351.62 342.33 349.98 93811800 328.7 363.64 1 1

2025.05.18D10:22:23.548140000 "UNH" "2025.05.18D10:22:20.279" 279.29 294.49 269.14 291.91 70637700 287.57 287.7 8 14

2025.05.18D10:22:23.548140000 "V" "2025.05.18D10:22:20.279" 362.95 366.19 360.89 365.12 5836500 363.55 365.25 8 9

2025.05.18D10:22:23.548140000 "WMT" "2025.05.18D10:22:20.279" 96.14 99.19 96 98.24 33708300 96.51 97.78 13 22

q.u))

If you were paying close attention, you may have noticed that the sym and feedHandlerTime columns are of type string i.e., lists of characters) instead of symbol and timestamp, respectively. Fortunately, we can easily correct this with a simple update statement:

q.u))update `$sym,"P"$feedHandlerTime from flip `time`sym`feedHandlerTime`open`high`low`close`volume`bid`ask`bidSize`askSize!flip a,'x

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

-------------------------------------------------------------------------------------------------------------------------------------

2025.05.18D10:22:23.548140000 AMZN 2025.05.18D10:22:20.279000000 206.85 206.85 204.37 205.59 43072700 205.49 205.77 3 3

2025.05.18D10:22:23.548140000 GOOGL 2025.05.18D10:22:20.279000000 167.73 169.35 165.62 166.19 42650100 166.14 166.26 7 7

2025.05.18D10:22:23.548140000 HD 2025.05.18D10:22:20.279000000 380.23 381.17 378.15 380.78 3127300 377.36 379.6 8 8

2025.05.18D10:22:23.548140000 JNJ 2025.05.18D10:22:20.279000000 149.67 151.5 149.22 151.33 8046000 151.1 151.1 8 9

2025.05.18D10:22:23.548140000 JPM 2025.05.18D10:22:20.279000000 267.5 268.46 264.71 267.56 8925900 264.5 266.01 12 8

2025.05.18D10:22:23.548140000 MA 2025.05.18D10:22:20.279000000 580.43 584.29 580.43 583.28 2225400 578.78 584.29 11 8

2025.05.18D10:22:23.548140000 META 2025.05.18D10:22:20.279000000 637.96 640.44 626.15 640.34 18405900 639.55 640.95 1 1

2025.05.18D10:22:23.548140000 MSFT 2025.05.18D10:22:20.279000000 452.05 454.36 448.73 454.27 23803400 443.32 454.45 1 2

2025.05.18D10:22:23.548140000 NVDA 2025.05.18D10:22:20.279000000 136.22 136.35 133.46 135.4 222651500 126.78 137 1 2

2025.05.18D10:22:23.548140000 PG 2025.05.18D10:22:20.279000000 162.65 163.43 161.85 163.28 7100200 163.17 163.49 9 8

2025.05.18D10:22:23.548140000 TSLA 2025.05.18D10:22:20.279000000 346.24 351.62 342.33 349.98 93811800 328.7 363.64 1 1

2025.05.18D10:22:23.548140000 UNH 2025.05.18D10:22:20.279000000 279.29 294.49 269.14 291.91 70637700 287.57 287.7 8 14

2025.05.18D10:22:23.548140000 V 2025.05.18D10:22:20.279000000 362.95 366.19 360.89 365.12 5836500 363.55 365.25 8 9

2025.05.18D10:22:23.548140000 WMT 2025.05.18D10:22:20.279000000 96.14 99.19 96 98.24 33708300 96.51 97.78 13 22

To verify that the column types have been updated correctly, we can inspect the table schema using the meta operator.

q.u))meta update `$sym,"P"$feedHandlerTime from flip `time`sym`feedHandlerTime`open`high`low`close`volume`bid`ask`bidSize`askSize!flip a,'x

c | t f a

---------------| -----

time | p

sym | s

feedHandlerTime| p

open | f

high | f

low | f

close | f

volume | j

bid | f

ask | f

bidSize | j

askSize | j

It's important to note that type conversions like the one above should not be performed at the Tickerplant level. This approach is tailored to a very specific dataset and goes against the principle of keeping the Tickerplant generic and adaptable to various data sources.

Ideally, the Tickerplant should remain as lightweight as possible, free of any dataset-specific business logic. A more appropriate place to handle this kind of transformation would be within the Feedhandler itself.

That said, for illustrative and educational purposes, we'll keep the code as-is for now.

Now, returning to our Tickerplant code, we make a few final adjustments, cleaning up anything unnecessary, before it's ready to run. You can find the final version of the code in my GitHub repo here.

Real-Time Database (RDB)

For the Real-Time Database (RDB), only minimal adjustments are needed. The main change is modifying the end-of-day save-down process: instead of persisting data to disk, which isn’t necessary for our current setup, we simply purge the data from the stocks table and start fresh the next day. We'll cover building a Historical Database (HDB) in a later stage.

Bringing it all to Life: Launching Your Real-Time KDB/Q Stack

Now that all the pieces are in place, it’s time to bring your real-time application to life.

We’ll start by launching the Tickerplant with the following command:

qq tick.q sym . -p 5010

Once it’s up and running, you can verify that the stocks table was correctly initialized by inspecting its contents and checking the schema using meta

alexanderunterrainer@Mac:~/repos/yfinData|⇒ qq tick.q sym . -p 5010

KDB+ 4.1 2025.02.18 Copyright (C) 1993-2025 Kx Systems

m64/ 8(24)core 24576MB alexanderunterrainer mac 192.168.1.177 EXPIRE 2026.03.11 KDB PLUS PERSONAL #5024911

q)stocks

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

---------------------------------------------------------------------------

q)meta stocks

c | t f a

---------------| -----

time | p s

sym | s g

feedHandlerTime| p

open | f

high | f

low | f

close | f

volume | i

bid | f

ask | f

bidSize | i

askSize | i

Next, start the Real-Time Database (RDB):

qq tick/r.q :5010 -p 5011

Again, confirm that everything is wired up properly by reviewing the data and table schema.

alexanderunterrainer@Mac:~/repos/yfinData|⇒ qq tick/r.q :5010 -p 5011

KDB+ 4.1 2025.02.18 Copyright (C) 1993-2025 Kx Systems

m64/ 8(24)core 24576MB alexanderunterrainer mac 192.168.1.177 EXPIRE 2026.03.11 KDB PLUS PERSONAL #5024911

q)stocks

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

---------------------------------------------------------------------------

Finally, kick off the Feedhandler, which will fetch stock data from Yahoo Finance every 30 seconds and stream it to the Tickerplant:

alexanderunterrainer@Mac:~/repos/yfinData|⇒ python3 yahoo_finance_streamer.py --tickers tickers.csv

2025-05-19 20:41:22,555 - INFO - Loaded 14 ticker symbols from tickers.csv

2025-05-19 20:41:22,555 - INFO - Connecting to KDB+ at localhost:5010 (attempt 1/3)

2025-05-19 20:41:22,556 - INFO - Successfully connected to KDB+: 3

2025-05-19 20:41:22,556 - INFO - Starting data streaming for 14 symbols at 30s intervals

2025-05-19 20:41:22,556 - INFO - Fetching data for batch 1: 14 symbols

2025-05-19 20:41:26,063 - INFO - Streamed 14 records to KDB+ table 'stocks'

2025-05-19 20:41:26,063 - INFO - Completed iteration 1. Next run at 20:41:52

2025-05-19 20:41:52,642 - INFO - Fetching data for batch 1: 14 symbols

2025-05-19 20:41:55,327 - INFO - Streamed 14 records to KDB+ table 'stocks'

2025-05-19 20:41:55,327 - INFO - Completed iteration 2. Next run at 20:42:22

2025-05-19 20:42:22,664 - INFO - Fetching data for batch 1: 14 symbols

2025-05-19 20:42:25,360 - INFO - Streamed 14 records to KDB+ table 'stocks'

2025-05-19 20:42:25,360 - INFO - Completed iteration 3. Next run at 20:42:52

Let’s take a closer look at the incoming data.

q)stocks

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

-------------------------------------------------------------------------------------------------------------------------------------------

2025.05.19D20:41:26.062916000 AMZN 2025.05.19D20:41:22.556000000 201.645 206.62 201.26 205.47 23999471 195.53 205.94 1 1

2025.05.19D20:41:26.062916000 GOOGL 2025.05.19D20:41:22.556000000 164.51 166.07 164.22 165.78 24114304 165.75 172 1 2

2025.05.19D20:41:26.062916000 HD 2025.05.19D20:41:22.556000000 374.19 381.145 374.23 379.49 2873584 379.27 379.26 13 8

2025.05.19D20:41:26.062916000 JNJ 2025.05.19D20:41:22.556000000 151.89 152.41 151.05 152.41 4847505 152.13 152.15 10 11

2025.05.19D20:41:26.062916000 JPM 2025.05.19D20:41:22.556000000 265.55 268.31 261.93 264.965 9446982 265.11 265.17 8 9

2025.05.19D20:41:26.062916000 MA 2025.05.19D20:41:22.556000000 581.015 588.45 580.48 585.265 1134011 585.04 585.29 11 8

2025.05.19D20:41:26.062916000 META 2025.05.19D20:41:22.556000000 628.25 643 627.9 639.038 7486566 609.58 658.53 1 4

2025.05.19D20:41:26.062916000 MSFT 2025.05.19D20:41:22.556000000 450.875 459.585 450.875 457.49 13771984 455.03 457.76 4 2

2025.05.19D20:41:26.062916000 NVDA 2025.05.19D20:41:22.556000000 132.41 135.87 132.41 135.216 164733322 134.99 135.45 1 1

2025.05.19D20:41:26.062916000 PG 2025.05.19D20:41:22.556000000 163.47 165.15 163.41 164.54 5727733 164.37 164.43 9 8

2025.05.19D20:41:26.062916000 TSLA 2025.05.19D20:41:22.556000000 336.34 343 333.38 342.3106 77338471 339 348 2 1

2025.05.19D20:41:26.062916000 UNH 2025.05.19D20:41:22.556000000 304.775 316.21 297.245 314.7999 55893400 312.55 312.43 11 14

2025.05.19D20:41:26.062916000 V 2025.05.19D20:41:22.556000000 363.02 369.1499 362.321 367.73 3239193 367.38 367.43 8 10

2025.05.19D20:41:26.062916000 WMT 2025.05.19D20:41:22.556000000 96.65 98.26 95.8101 98.189 13795258 98.05 98.07 10 10

q)stocks

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

-------------------------------------------------------------------------------------------------------------------------------------------

2025.05.19D20:41:26.062916000 AMZN 2025.05.19D20:41:22.556000000 201.645 206.62 201.26 205.47 23999471 195.53 205.94 1 1

2025.05.19D20:41:26.062916000 GOOGL 2025.05.19D20:41:22.556000000 164.51 166.07 164.22 165.78 24114304 165.75 172 1 2

2025.05.19D20:41:26.062916000 HD 2025.05.19D20:41:22.556000000 374.19 381.145 374.23 379.49 2873584 379.27 379.26 13 8

2025.05.19D20:41:26.062916000 JNJ 2025.05.19D20:41:22.556000000 151.89 152.41 151.05 152.41 4847505 152.13 152.15 10 11

2025.05.19D20:41:26.062916000 JPM 2025.05.19D20:41:22.556000000 265.55 268.31 261.93 264.965 9446982 265.11 265.17 8 9

2025.05.19D20:41:26.062916000 MA 2025.05.19D20:41:22.556000000 581.015 588.45 580.48 585.265 1134011 585.04 585.29 11 8

2025.05.19D20:41:26.062916000 META 2025.05.19D20:41:22.556000000 628.25 643 627.9 639.038 7486566 609.58 658.53 1 4

2025.05.19D20:41:26.062916000 MSFT 2025.05.19D20:41:22.556000000 450.875 459.585 450.875 457.49 13771984 455.03 457.76 4 2

2025.05.19D20:41:26.062916000 NVDA 2025.05.19D20:41:22.556000000 132.41 135.87 132.41 135.216 164733322 134.99 135.45 1 1

2025.05.19D20:41:26.062916000 PG 2025.05.19D20:41:22.556000000 163.47 165.15 163.41 164.54 5727733 164.37 164.43 9 8

2025.05.19D20:41:26.062916000 TSLA 2025.05.19D20:41:22.556000000 336.34 343 333.38 342.3106 77338471 339 348 2 1

2025.05.19D20:41:26.062916000 UNH 2025.05.19D20:41:22.556000000 304.775 316.21 297.245 314.7999 55893400 312.55 312.43 11 14

2025.05.19D20:41:26.062916000 V 2025.05.19D20:41:22.556000000 363.02 369.1499 362.321 367.73 3239193 367.38 367.43 8 10

2025.05.19D20:41:26.062916000 WMT 2025.05.19D20:41:22.556000000 96.65 98.26 95.8101 98.189 13795258 98.05 98.07 10 10

2025.05.19D20:41:55.327104000 AMZN 2025.05.19D20:41:52.643000000 201.645 206.62 201.26 205.52 24022841 200 205.94 2 1

2025.05.19D20:41:55.327104000 GOOGL 2025.05.19D20:41:52.643000000 164.51 166.07 164.22 165.84 24144223 165.75 172 1 2

2025.05.19D20:41:55.327104000 HD 2025.05.19D20:41:52.643000000 374.19 381.145 374.23 379.475 2877334 379.27 379.31 13 8

2025.05.19D20:41:55.327104000 JNJ 2025.05.19D20:41:52.643000000 151.89 152.41 151.05 152.395 4854132 152.12 152.14 10 11

2025.05.19D20:41:55.327104000 JPM 2025.05.19D20:41:52.643000000 265.55 268.31 261.93 264.975 9457337 265.11 265.18 8 9

2025.05.19D20:41:55.327104000 MA 2025.05.19D20:41:52.643000000 581.015 588.45 580.48 585.35 1137405 585.04 585.44 11 8

2025.05.19D20:41:55.327104000 META 2025.05.19D20:41:52.643000000 628.25 643 627.9 639.35 7497210 609.58 658.53 1 4

2025.05.19D20:41:55.327104000 MSFT 2025.05.19D20:41:52.643000000 450.875 459.585 450.875 457.5375 13786633 455.03 457.76 4 2

2025.05.19D20:41:55.327104000 NVDA 2025.05.19D20:41:52.643000000 132.41 135.87 132.41 135.265 164894932 135.05 135.51 1 1

2025.05.19D20:41:55.327104000 PG 2025.05.19D20:41:52.643000000 163.47 165.15 163.41 164.545 5732887 164.37 164.43 9 8

2025.05.19D20:41:55.327104000 TSLA 2025.05.19D20:41:52.643000000 336.34 343 333.38 342.4911 77449325 339 342.53 2 1

2025.05.19D20:41:55.327104000 UNH 2025.05.19D20:41:52.643000000 304.775 316.21 297.245 314.575 55935141 312.8 312.92 11 14

2025.05.19D20:41:55.327104000 V 2025.05.19D20:41:52.643000000 363.02 369.1499 362.321 367.72 3245083 367.38 367.54 8 10

2025.05.19D20:41:55.327104000 WMT 2025.05.19D20:41:52.643000000 96.65 98.26 95.8101 98.1883 13833048 98.07 98.07 10 10

q)count stocks

28

q)stocks

time sym feedHandlerTime open high low close volume bid ask bidSize askSize

-------------------------------------------------------------------------------------------------------------------------------------------

2025.05.19D20:41:26.062916000 AMZN 2025.05.19D20:41:22.556000000 201.645 206.62 201.26 205.47 23999471 195.53 205.94 1 1

2025.05.19D20:41:26.062916000 GOOGL 2025.05.19D20:41:22.556000000 164.51 166.07 164.22 165.78 24114304 165.75 172 1 2

2025.05.19D20:41:26.062916000 HD 2025.05.19D20:41:22.556000000 374.19 381.145 374.23 379.49 2873584 379.27 379.26 13 8

2025.05.19D20:41:26.062916000 JNJ 2025.05.19D20:41:22.556000000 151.89 152.41 151.05 152.41 4847505 152.13 152.15 10 11

2025.05.19D20:41:26.062916000 JPM 2025.05.19D20:41:22.556000000 265.55 268.31 261.93 264.965 9446982 265.11 265.17 8 9

2025.05.19D20:41:26.062916000 MA 2025.05.19D20:41:22.556000000 581.015 588.45 580.48 585.265 1134011 585.04 585.29 11 8

2025.05.19D20:41:26.062916000 META 2025.05.19D20:41:22.556000000 628.25 643 627.9 639.038 7486566 609.58 658.53 1 4

2025.05.19D20:41:26.062916000 MSFT 2025.05.19D20:41:22.556000000 450.875 459.585 450.875 457.49 13771984 455.03 457.76 4 2

2025.05.19D20:41:26.062916000 NVDA 2025.05.19D20:41:22.556000000 132.41 135.87 132.41 135.216 164733322 134.99 135.45 1 1

2025.05.19D20:41:26.062916000 PG 2025.05.19D20:41:22.556000000 163.47 165.15 163.41 164.54 5727733 164.37 164.43 9 8

2025.05.19D20:41:26.062916000 TSLA 2025.05.19D20:41:22.556000000 336.34 343 333.38 342.3106 77338471 339 348 2 1

2025.05.19D20:41:26.062916000 UNH 2025.05.19D20:41:22.556000000 304.775 316.21 297.245 314.7999 55893400 312.55 312.43 11 14

2025.05.19D20:41:26.062916000 V 2025.05.19D20:41:22.556000000 363.02 369.1499 362.321 367.73 3239193 367.38 367.43 8 10

2025.05.19D20:41:26.062916000 WMT 2025.05.19D20:41:22.556000000 96.65 98.26 95.8101 98.189 13795258 98.05 98.07 10 10

2025.05.19D20:41:55.327104000 AMZN 2025.05.19D20:41:52.643000000 201.645 206.62 201.26 205.52 24022841 200 205.94 2 1

2025.05.19D20:41:55.327104000 GOOGL 2025.05.19D20:41:52.643000000 164.51 166.07 164.22 165.84 24144223 165.75 172 1 2

2025.05.19D20:41:55.327104000 HD 2025.05.19D20:41:52.643000000 374.19 381.145 374.23 379.475 2877334 379.27 379.31 13 8

2025.05.19D20:41:55.327104000 JNJ 2025.05.19D20:41:52.643000000 151.89 152.41 151.05 152.395 4854132 152.12 152.14 10 11

2025.05.19D20:41:55.327104000 JPM 2025.05.19D20:41:52.643000000 265.55 268.31 261.93 264.975 9457337 265.11 265.18 8 9

2025.05.19D20:41:55.327104000 MA 2025.05.19D20:41:52.643000000 581.015 588.45 580.48 585.35 1137405 585.04 585.44 11 8

2025.05.19D20:41:55.327104000 META 2025.05.19D20:41:52.643000000 628.25 643 627.9 639.35 7497210 609.58 658.53 1 4

2025.05.19D20:41:55.327104000 MSFT 2025.05.19D20:41:52.643000000 450.875 459.585 450.875 457.5375 13786633 455.03 457.76 4 2

2025.05.19D20:41:55.327104000 NVDA 2025.05.19D20:41:52.643000000 132.41 135.87 132.41 135.265 164894932 135.05 135.51 1 1

2025.05.19D20:41:55.327104000 PG 2025.05.19D20:41:52.643000000 163.47 165.15 163.41 164.545 5732887 164.37 164.43 9 8

2025.05.19D20:41:55.327104000 TSLA 2025.05.19D20:41:52.643000000 336.34 343 333.38 342.4911 77449325 339 342.53 2 1

2025.05.19D20:41:55.327104000 UNH 2025.05.19D20:41:52.643000000 304.775 316.21 297.245 314.575 55935141 312.8 312.92 11 14

2025.05.19D20:41:55.327104000 V 2025.05.19D20:41:52.643000000 363.02 369.1499 362.321 367.72 3245083 367.38 367.54 8 10

2025.05.19D20:41:55.327104000 WMT 2025.05.19D20:41:52.643000000 96.65 98.26 95.8101 98.1883 13833048 98.07 98.07 10 10

2025.05.19D20:42:25.360198000 AMZN 2025.05.19D20:42:22.665000000 201.645 206.62 201.26 205.51 24037280 195.53 205.94 1 1

2025.05.19D20:42:25.360198000 GOOGL 2025.05.19D20:42:22.665000000 164.51 166.07 164.22 165.815 24171372 165.75 172 1 2

2025.05.19D20:42:25.360198000 HD 2025.05.19D20:42:22.665000000 374.19 381.145 374.23 379.43 2882141 379.12 379.31 13 8

2025.05.19D20:42:25.360198000 JNJ 2025.05.19D20:42:22.665000000 151.89 152.41 151.05 152.39 4856696 152.12 152.14 10 11

2025.05.19D20:42:25.360198000 JPM 2025.05.19D20:42:22.665000000 265.55 268.31 261.93 264.8824 9464132 265.09 265.11 8 9

2025.05.19D20:42:25.360198000 MA 2025.05.19D20:42:22.665000000 581.015 588.45 580.48 585.26 1138452 585.04 585.44 11 8

2025.05.19D20:42:25.360198000 META 2025.05.19D20:42:22.665000000 628.25 643 627.9 639.095 7503508 609.58 658.53 1 4

2025.05.19D20:42:25.360198000 MSFT 2025.05.19D20:42:22.665000000 450.875 459.585 450.875 457.46 13795208 455.03 457.76 4 2

2025.05.19D20:42:25.360198000 NVDA 2025.05.19D20:42:22.665000000 132.41 135.87 132.41 135.245 164987096 135.03 135.49 1 1

2025.05.19D20:42:25.360198000 PG 2025.05.19D20:42:22.665000000 163.47 165.15 163.41 164.565 5738934 164.38 164.41 9 8

2025.05.19D20:42:25.360198000 TSLA 2025.05.19D20:42:22.665000000 336.34 343 333.38 342.26 77520926 339 348 2 1

2025.05.19D20:42:25.360198000 UNH 2025.05.19D20:42:22.665000000 304.775 316.21 297.245 314.57 56023879 312.8 312.92 11 14

2025.05.19D20:42:25.360198000 V 2025.05.19D20:42:22.665000000 363.02 369.1499 362.321 367.71 3247511 367.38 367.54 8 10

2025.05.19D20:42:25.360198000 WMT 2025.05.19D20:42:22.665000000 96.65 98.26 95.8101 98.195 13851133 97.99 98.07 10 10

q)count stocks

42

q)meta stocks

c | t f a

---------------| -----

time | p s

sym | s g

feedHandlerTime| p

open | f

high | f

low | f

close | f

volume | i

bid | f

ask | f

bidSize | i

askSize | i

Let it run as long as you'd like, and when you're ready to shut it down, simply press CTRL+C to exit the Python script.

2025-05-19 20:42:25,360 - INFO - Completed iteration 3. Next run at 20:42:52

^C2025-05-19 20:42:48,192 - INFO - Received keyboard interrupt. Shutting down...

2025-05-19 20:42:48,192 - INFO - Closed KDB+ connection

I hope you found this tutorial useful and got a glimpse of the power and flexibility of KDB/Q, especially how straightforward it can be to build a real-time streaming application. In the next tutorial, we’ll learn how to build a historical stock price database for research purposes. Stay tuned!