Pulse Powered Alpha: Building your First Trading Strategy with KDB-X and Pulse

In the previous tutorials, we explored how to build a Tickerplant, pull real-time market data from providers like Yahoo and Databento, and create a research-focused historical database. Now it’s time to bring all these pieces together. In this tutorial, we’ll build our first (simple) trading strategy, visualize it in a dashboard, and even demonstrate how to create a backtesting engine to evaluate its performance.

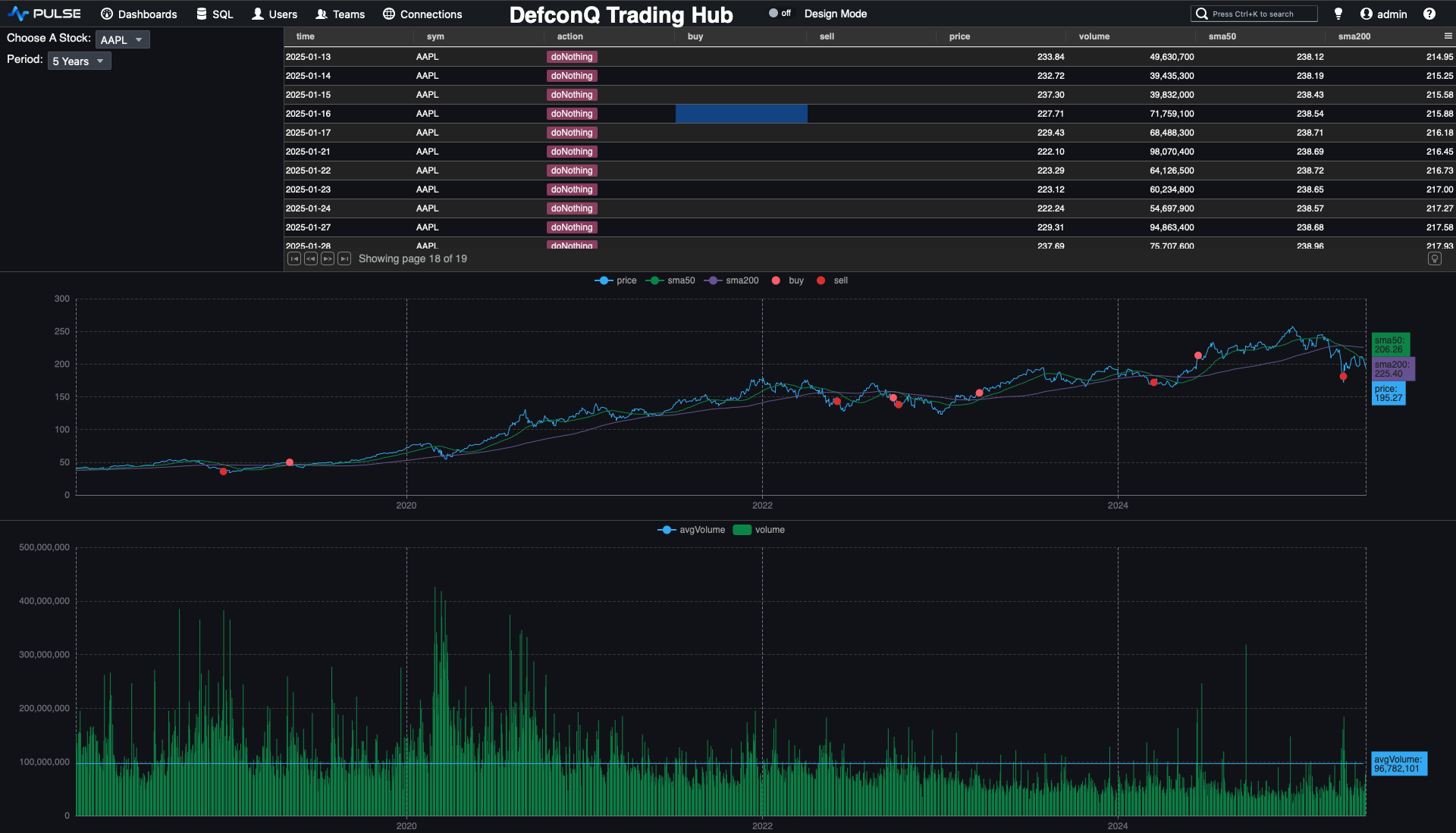

Here’s what the final dashboard will look like.

Before We Dive In: Gearing Up for the Strategy Build

Since we’ll be reusing parts of the code introduced in earlier tutorials, it’s helpful to familiarise yourself with those foundations, they’re explained in detail and will make this tutorial much easier to follow. Don’t worry, though: all new additions will be fully explained as we go. To visualise our trading strategy and build the dashboard, you’ll also need to install Pulse. Installation instructions are provided below.

Prerequisites:

- Review the previous tutorials to understand the core building blocks we’ll build on

- Install Pulse: Follow the instructions here

Blueprints Before Code: Designing Your Trading Engine the Right Way

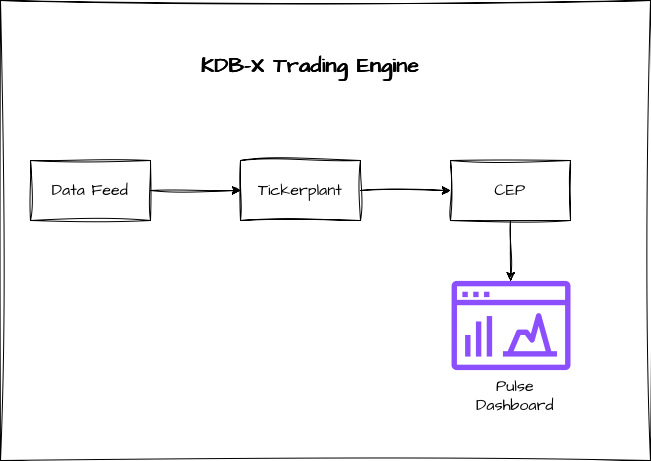

Before we jump into writing any code, it’s worth pausing to look at the most critical part of building any solid application: the architecture. Even a small, simple system benefits enormously from a clean, extensible design. With that mindset, here’s how we’ll structure our trading engine:

- Data Ingestion: A dedicated process responsible for feeding market data into our Tickerplant.

- Tickerplant: The heartbeat of every KDB-X application. It streams incoming data to all real-time subscribers and writes each update to a Tickerplant Log file, ensuring the system can recover seamlessly if needed.

- Complex Event Processing Engine (CEP): This component serves as our trading engine, executing the strategy logic and generating signals based on the incoming data.

Feeding the Beast: Bringing Data Into Your Trading Engine

For this tutorial, we’ll use end-of-day files from Yahoo Finance, the same dataset we worked with in an earlier tutorial. You can reuse those files or download fresh ones if you prefer. We'll write a function that loads these files into memory and publishes the data to our Tickerplant. And since we also want to build a backtesting engine, we’ll stream the historical data on a timer to simulate a “time-lapse” playback of market history.

Let’s get started.

First, we define the table schema for the data we want to load and gather the filenames of all historical data files into a variable. When following along, remember to update the file path to match the location of your own data. Also make sure that the folder contains only data files, as the key operator will list everything inside that directory.

// Define table schema for data we are going to load

data:([] time:`timestamp$(); sym:`symbol$(); feedHandlerTime: `timestamp$(); open: `float$(); high: `float$(); low: `float$(); close: `float$(); volume: `long$());

// List of files we want to load (Change this path to your file location. Note:folder should only contain your data as everything in the folder will be loaded)

fileList:key `$":/Users/alexanderunterrainer/repos/defconQ/projects/tradingStrategy/stock_data";

loadData:{[file]

// Extract the name of the stock from the file name

name:`$first "_" vs string file;

// Load the data for the specific file, update the sym column with the stock name and a feedHandlerTime

`data insert update sym:name,`timestamp$`date$time,feedHandlerTime:time from `time`open`high`low`close`volume xcol ("PFFFFJ";enlist csv) 0:hsym file;

};

After defining our function, we can run it

q)loadData each fileList;

Before we can start streaming any data, we first need to bring up the Tickerplant. For this tutorial, we’re using an even more stripped-down version of the plain vanilla Tickerplant. If you’d like a detailed, line-by-line explanation of how it works, check out my walkthrough linked here.

For now, let’s go ahead and start the Tickerplant.

alexanderunterrainer@Mac:~/repos/defconQ/projects/tradingStrategy|master⚡ ⇒ qx tick.q sym . -p 5010

KDB-X 0.1.1 2025.09.29 Copyright (C) 1993-2025 Kx Systems

q)stocks

time sym feedHandlerTime open high low close volume

---------------------------------------------------

q)

Once the Tickerplant is up and running, we can connect to it using hopen, which creates a connection handle between our feed handler and the Tickerplant. From there, we’re able to publish our data. Since we haven’t started any real-time subscribers yet, the Tickerplant will simply write the updates to its log file without broadcasting them to any subscribers.

q)h:hopen 5010

q)h(`.u.upd;`stocks;data)

Now that our data pipeline is in place, it’s time to build the Complex Event Processing Engine that will execute our trading strategy.

Complex Event Processing Engine (CEP): Effortless Business Logic in Motion

For our trading strategy, we’ll implement a straightforward moving average crossover model. It uses two averages: a short-term 50-day moving average and a long-term 200-day one. The signal rules are simple: when the short average crosses above the long average, we generate a buy signal; when it crosses below, we trigger a sell signal. This captures the classic idea that prices tend to revert toward their longer-term trend over time.

Calculating the moving averages couldn’t be easier, KDB-X gives us the mavg keyword out of the box. This is another perfect example of why it excels at analytical workloads. Using mavg, we can directly update our table with both moving averages. The only detail to watch out for is that our dataset contains multiple symbols, so we need to compute the averages for each symbol. That’s easily achieved using a by clause as you can see in the line below

q)update sma50:mavg[50;close],sma200:mavg[200;close] by sym from `stocks

`stocks

So far so good, we’ve made solid progress. But now it’s time to bring our data to life. Let’s start building our dashboard. As a reminder, this is what the final result will look like:

Pulse: The Catwalk for Your Data Model

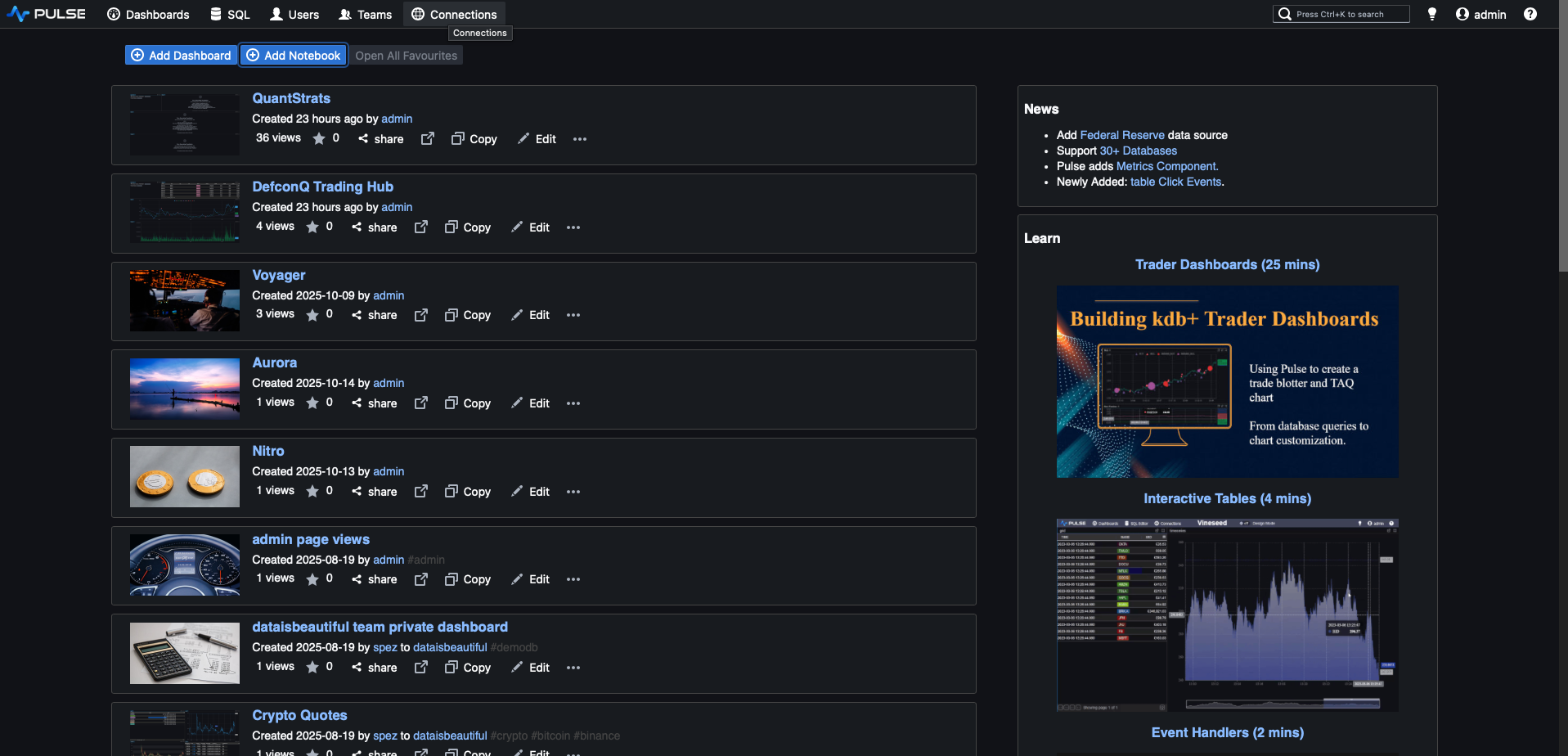

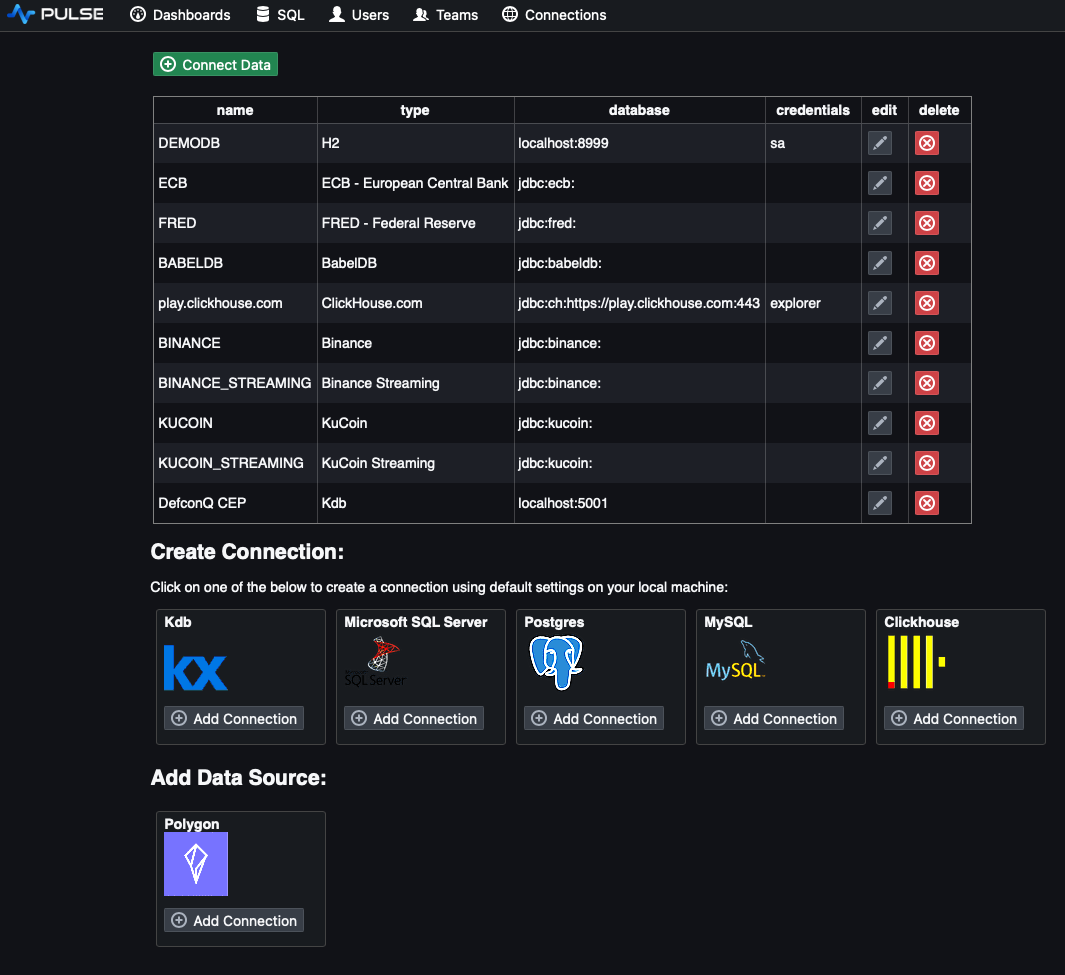

For those who know me, I’m much more of a backend person, I usually steer clear of UI and front-end work. But Pulse is so simple and intuitive that even I found myself almost enjoying the UI side of things. Once you’ve installed Pulse (installation guide linked here), you can launch it directly from your terminal. This opens a new tab in your browser where you can begin designing your dashboard. The first step is to set up a connection to the KDB-X process that holds our data.

// Start Pulse from your terminal. This will launch Pulse and open the landing page

alexanderunterrainer@Mac:~|⇒ java -jar pulse.jar

Pulse Landing Page

Pulse Landing Page

Now let’s create a new connection by specifying the host and port. In our example, the process is running on localhost using port 5001.

With the connection configured, we can move on to creating our dashboard. Go ahead and add a new one to get started.

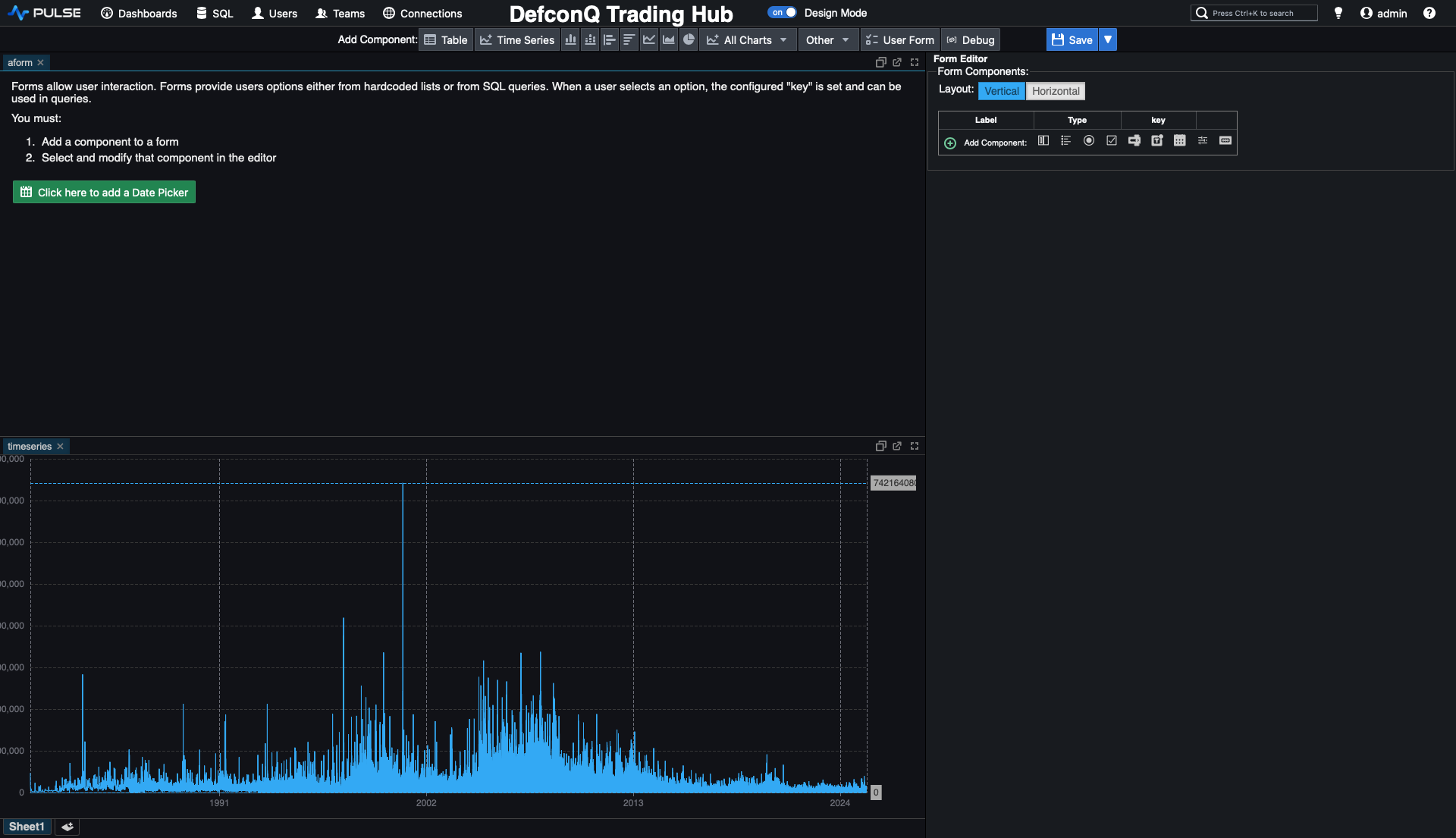

A new dashboard will open in design mode, and we can start adding components right away. I’m a big believer in the “low-hanging fruit principle”, tackle the easiest wins first. So let’s begin by charting the volume. Before that, though, let’s quickly save and rename our dashboard.

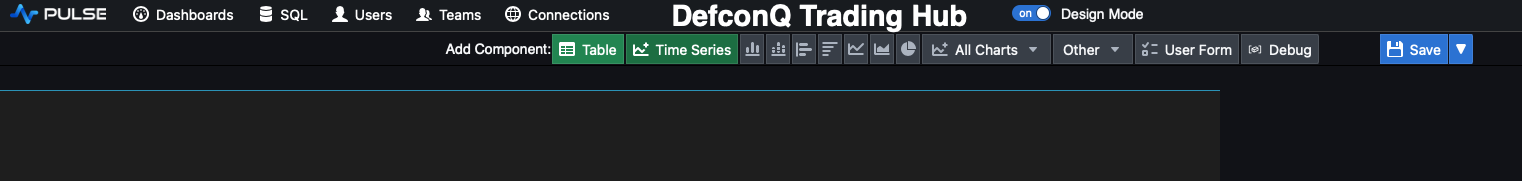

Once that’s done, click the Time Series button in the top panel to add a new time-series chart.

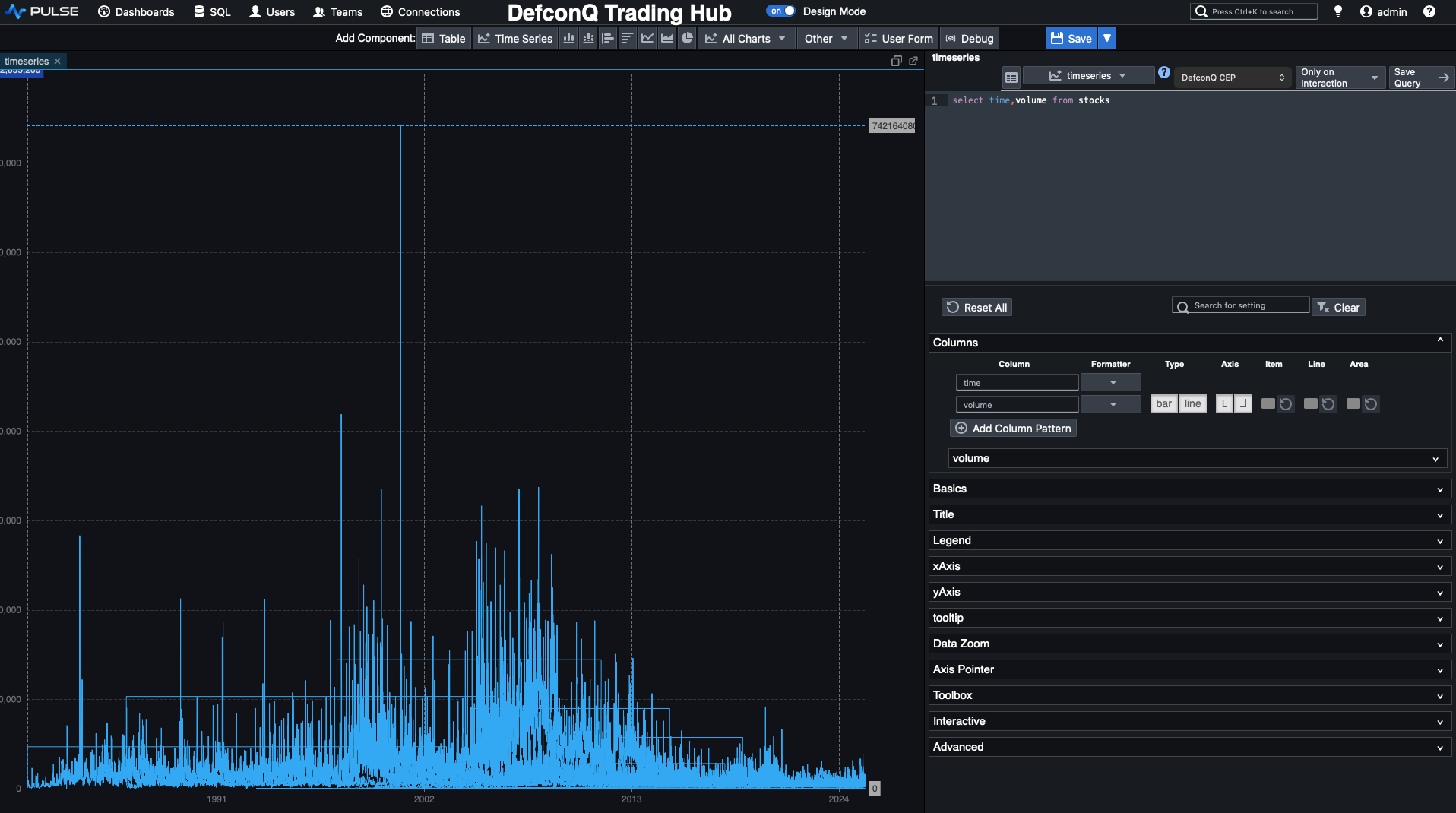

Pulse will generate a placeholder chart with simulated data, which we can now replace by updating the query to display the volume we’re interested in.

// Query for volume

`time xasc select time,volume from stocks

Hold on, something looks off. There are far too many data points, and the volume fluctuations don’t make much sense. That’s because our stocks table contains data for multiple symbols, so when we chart the volume directly, we’re plotting everything at once. The fix is simple: we add a drop-down selector so we can choose the specific stock we want to display.

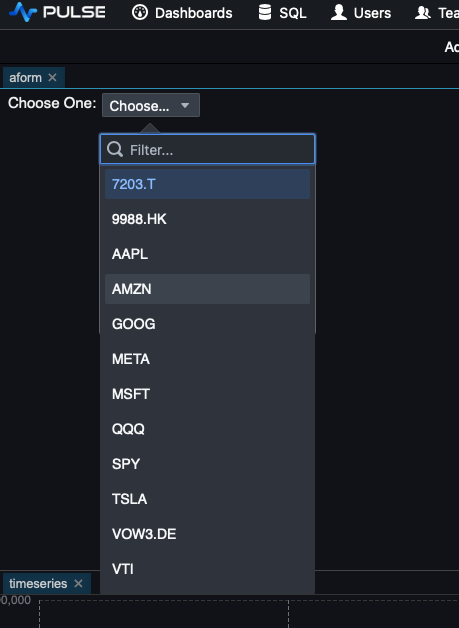

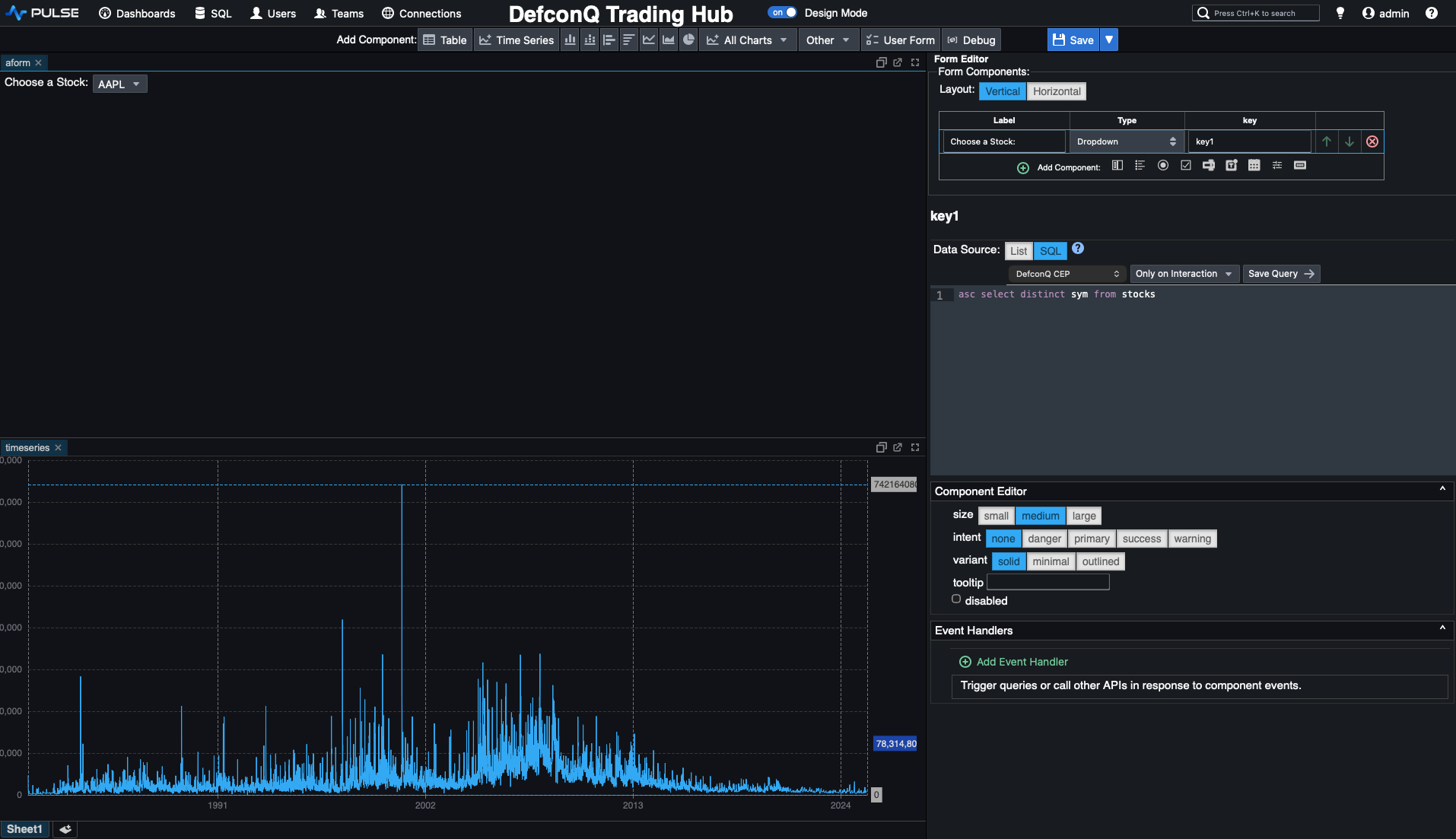

To do this, add a User Form. Click the User Form button in the top panel and place it above your volume chart. Then, in the Form Editor on the right, add a Dropdown component. We can populate the drop-down with our stock symbols by running a simple KDB-X query. Details below.

asc select distinct sym from stocks

All that’s left is to connect the drop-down to our volume chart so that selecting a symbol updates the chart accordingly. We can do this by referencing the drop-down’s assigned key directly in the chart’s query. The updated query looks like this:

`time xasc select time,volume from stocks where sym=`${{key1}}

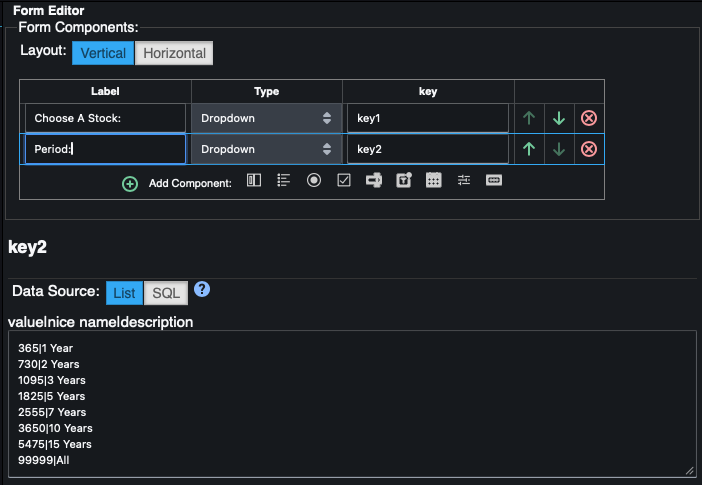

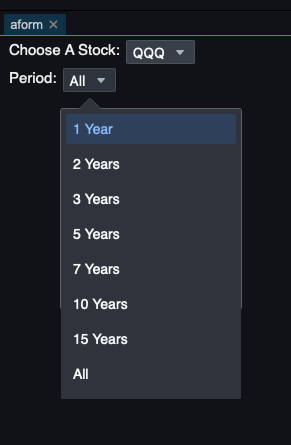

Not too bad, right? Since our historical dataset spans several decades, it’s useful to control how much of it we display at once. Let’s add another drop-down to let us choose the time range. Later, when we switch to real-time backtesting, this drop-down won’t be needed anymore and can be removed.

We start by adding another drop-down to choose the date range we want to display. This time, instead of populating the options with a Q-SQL query, we simply hard-code a list of day counts that correspond to 1, 2, 3, 5, 7, 10, and 15 years. We also include a large value to allow selecting the full time series.

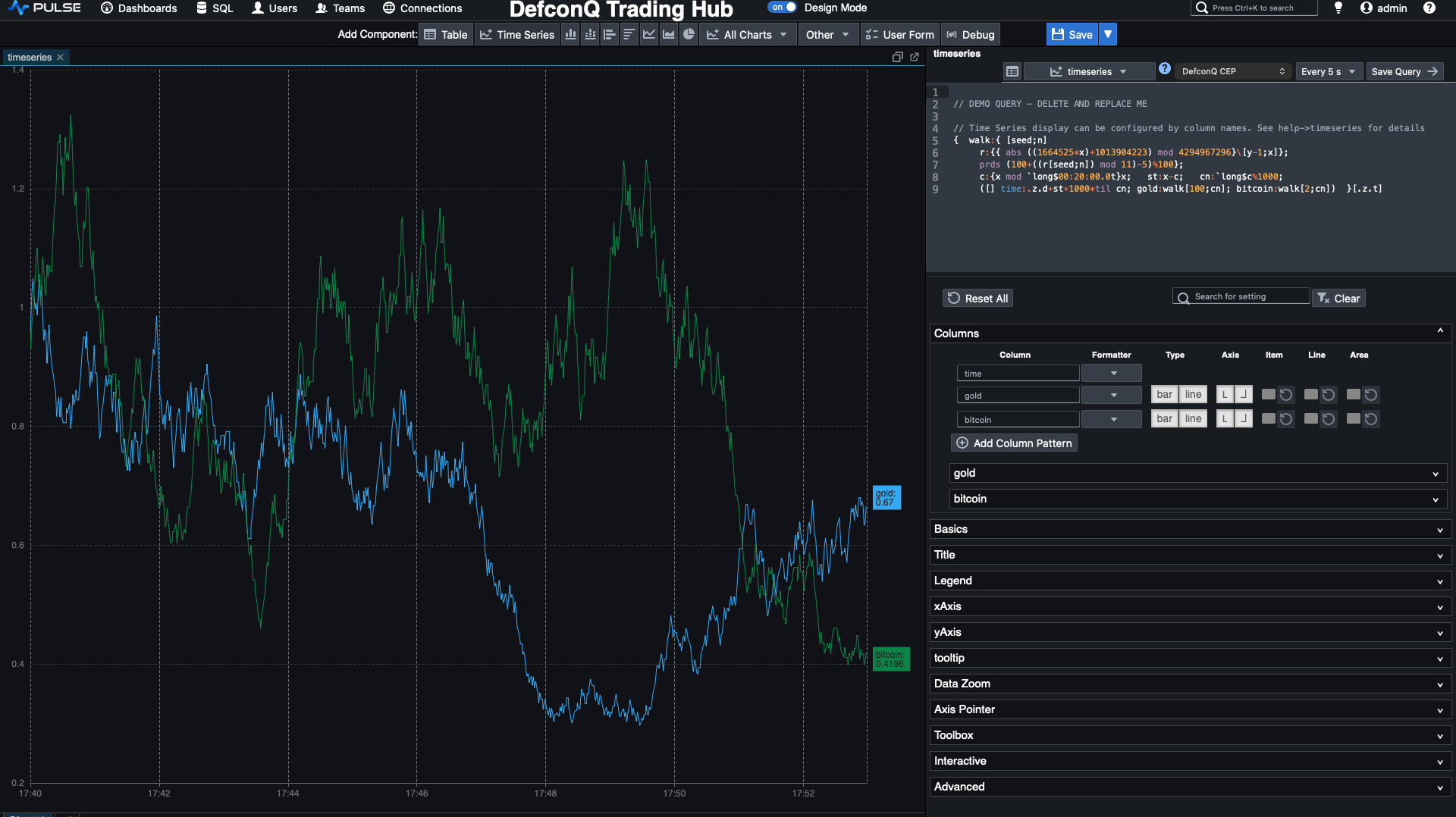

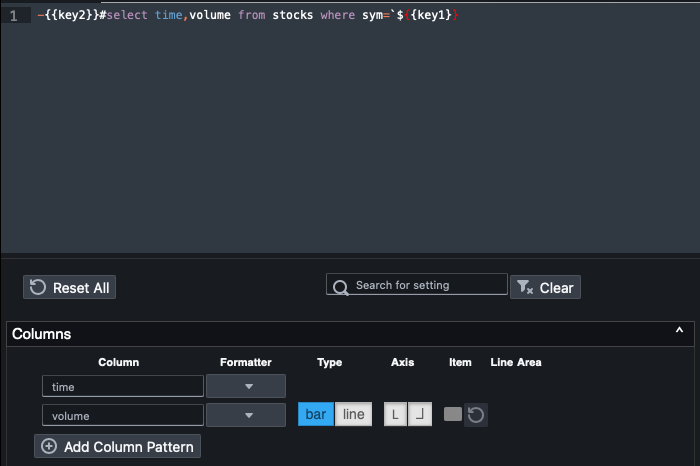

Next, we update the volume query to incorporate the drop-down’s key so the chart adjusts based on the selected range. For a small visual upgrade, we switch the chart from a line plot to a bar chart, and just like that, we have a clean, intuitive volume visualization for our stocks.

-{{key2}}#select time,volume from stocks where sym=`${{key1}}

Alright, with the volume chart in place, it’s time to move on to the price chart and start implementing our trading strategy. As before, we’ll tackle the easy part first, plotting the price series along with the moving averages.

Just like we did for the volume chart, we’ll add a new time-series component and define a Q-SQL query that selects the time, close, sma50 (50-day simple moving average), and sma200 (200-day simple moving average). As before, we’ll use the values from our drop-downs to limit the chart to a specific stock and chosen time range.

And just like that, we now have a clean visual of the price data alongside both moving averages. But how do we turn this into trading signals? Our rules are simple:

- buy when the short-term moving average (

sma50) crosses above the long-term average (sma200). - sell when the short-term moving average (

sma50) crosses below the long-term average (sma200).

Instead of jumping straight into solving this on our full dataset, let’s first strip the problem down and build the logic step by step. We’ll start with two simple lists: one for the short moving average and one for the long moving average:

s: 3 7 8 12 10 11 9 7(short MA)l: 5 9 10 11 8 7 12 13(long MA)

First, we subtract the long moving average l from the short moving average s. This tells us whether the short MA is above or below the long MA at each point.

Next, we apply the built-in signum function to that result. signum returns -1 for negative values, 1 for positive values, and 0 when the input is zero. We then compare this list against 0 to get a boolean mask indicating where the short MA is below the long MA. This effectively captures when the relationship between the two averages flips from negative to positive (or the other way around).

Finally, we use deltas on this boolean sequence to generate our trading signals:

- A delta of

+1→ we buy - A delta of

-1→ we sell - A delta of

0→ we do nothing

q)s:3 7 8 12 10 11 9 7

q)l:5 9 10 11 8 7 12 13

q)s-l

-2 -2 -2 1 2 4 -3 -6

q)signum s-l

-1 -1 -1 1 1 1 -1 -1i

q)0<signum s-l

00011100b

q)deltas 0<signum s-l

0 0 0 1 0 0 -1 0i

q)1+deltas 0<signum s-l

1 1 1 2 1 1 0 1

q)`sell`doNothing`buy 1+deltas 0<signum s-l

`doNothing`doNothing`doNothing`buy`doNothing`doNothing`sell`doNothing

The final step is to use the deltas output as an index into a list of symbols, allowing us to map the numeric values directly to their corresponding trading signals.

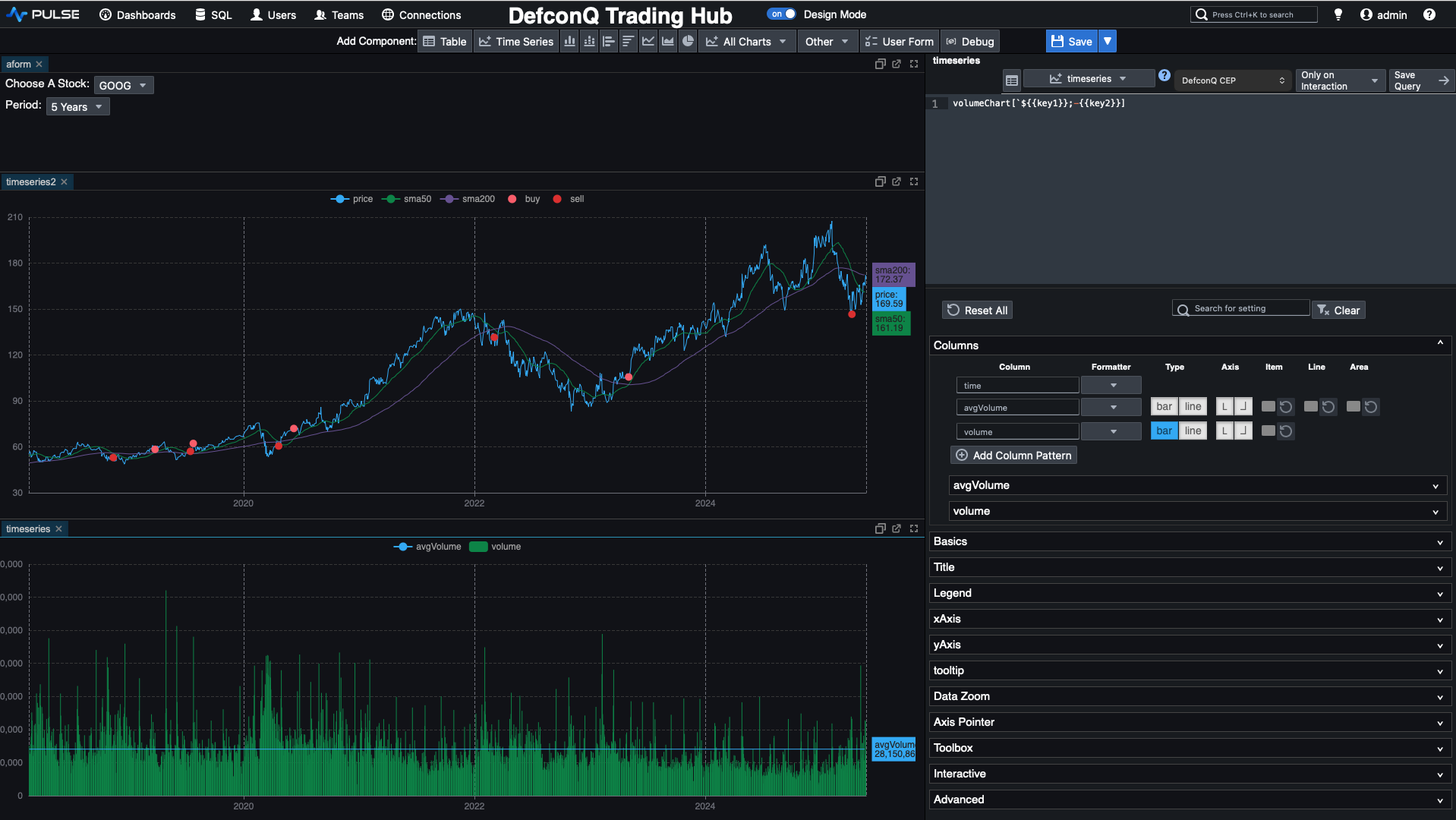

Now let’s integrate the signal-generation logic into our dashboard so we can produce a chart like the one shown below. It’s not particularly complicated, but it does require a few lines of code. We’ll also take advantage of some built-in Pulse features to display those nice visual marker, bubbles that highlight each buy or sell signal right on the chart.

Pulse is extremely flexible and even lets you write logic directly inside the chart’s code editor. However, to keep things clean and maintainable, we’ll follow good coding practices and wrap our logic in a function that Pulse can call, with parameters controlled by the UI.

We’ll create a function called priceChart that takes two arguments: the stock symbol we want to plot and the time range (in days). We’ll build it step by step. First, we reuse the original query that returns the price and the two moving averages.

select time,sym,sma50:mavg[50;close],sma200:mavg[200;close],price:close from stocks where sym=stock

Then we extend that result with our signal-generation logic, keeping the numeric encoding for now: -1 for sell, 1 for buy, and 0 for no action.

update signal:deltas 0<signum sma50-sma200 from

select time,sym,sma50:mavg[50;close],sma200:mavg[200;close],price:close from stocks where sym=stock

Next, we derive a trade action and the corresponding buy/sell price, which for simplicity we set to the closing price at the signal time (ignoring bid/ask). After that, we create the visual “bubbles” that mark buys and sells using Pulse’s built-in conventions: if you add a column named <field>_SD_CIRCLE and define <field>_SD_SIZE, Pulse will draw a bubble of that size at the corresponding point. By adding four columns, buy_SD_CIRCLE, buy_SD_SIZE, sell_SD_CIRCLE, and sell_SD_SIZE, we get clear visual markers for our buy and sell signals.

update buy_SD_CIRCLE:buy*signal,buy_SD_SIZE:10,sell_SD_CIRCLE:abs sell*signal,sell_SD_SIZE:10 from

update action:`sell`doNothing`buy 1+signal,buy:?[signal=1;price;0N],sell:?[-1=signal;price;0n] from

update signal:deltas 0<signum sma50-sma200 from

select time,sym,sma50:mavg[50;close],sma200:mavg[200;close],price:close from stocks where sym=stock

In the final step, we narrow things down to just the columns we care about and apply sublist to restrict the output to the selected date range. Here’s the full function in one piece.

priceChart:{[stock;range]

sublist[range;] select time,price,sma50,sma200,buy_SD_CIRCLE,buy_SD_SIZE,sell_SD_CIRCLE,sell_SD_SIZE from

update buy_SD_CIRCLE:buy*signal,buy_SD_SIZE:10,sell_SD_CIRCLE:abs sell*signal,sell_SD_SIZE:10 from

update action:`sell`doNothing`buy 1+signal,buy:?[signal=1;price;0N],sell:?[-1=signal;price;0n] from

update signal:deltas 0<signum sma50-sma200 from

select time,sym,sma50:mavg[50;close],sma200:mavg[200;close],price:close from stocks where sym=stock}

Following the same good coding practices, let’s also create a dedicated function for the volume chart.

volumeChart:{[stock;range] select time, avgVolume:avg volume, volume from sublist[range;] select time,volume from stocks where sym=stock }

As you’ve probably noticed, we also added the average volume to our volume chart. However, because KDB-X evaluates expressions from right to left, we can’t just compute the average volume first and then apply sublist, that would calculate the average over the entire dataset, giving us the wrong value for the selected time window.

To get the correct result, we must first extract the sublist for the chosen date range and then compute the average volume on that subset.

If you’re wondering why we use sublist instead of the take # operator, it comes down to their different behaviors. When you use take # on a list of 5 elements and request 7, take will start cycling through the list again from the beginning to reach the desired length. In contrast, sublist returns only min(n; count list) elements.

This matters when a stock’s price history is shorter than the time range the user selects, sublist prevents accidental cycling and ensures we only return the data that actually exists.

q)7#til 5

0 1 2 3 4 0 1

q)7 sublist til 5

0 1 2 3 4

Now that our functions are in place, the final step is simply adding them into our Pulse dashboard. We just add the function calls to the TimeSeries code editor and pass in the selected stock and time-range values from our drop-down inputs. That’s all it takes, let’s hook everything up.

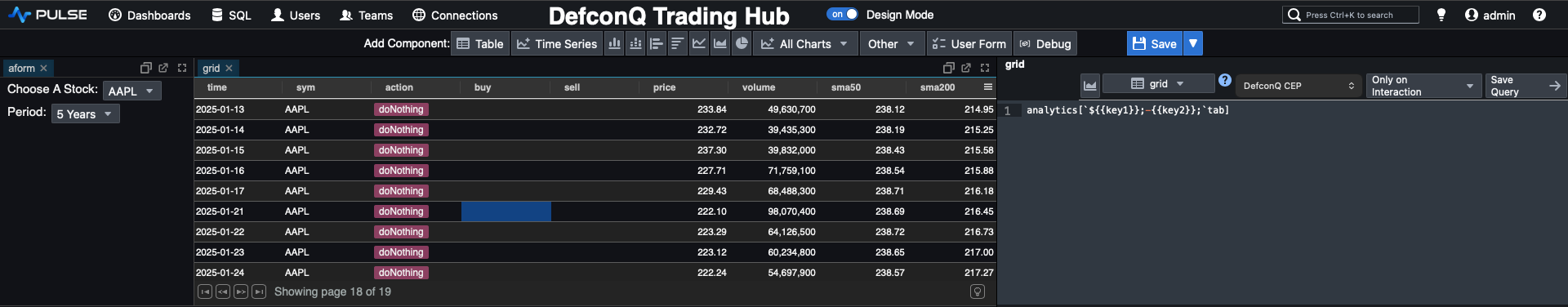

The last element to complete our dashboard is a summary table positioned at the top. This table presents key information at a glance, buy or sell price, the generated signal, volume, SMA50, SMA200, and the current price. It adds a numerical layer of context to complement the visual cues from our charts, rounding out the trading interface with clear, actionable insight.

If we look closely at our priceChart function, we’ll notice that nearly all the data required for our summary table is already being produced. The only real difference is the set of columns we want to return. So instead of duplicating logic, we’ll refactor the function, rename it to analytics, and introduce a third parameter that specifies which column set we want, whether for the price chart or for the summary table.

By using a functional select, we can make the underlying query far more flexible and dynamic. It’s yet another great example of how expressive and powerful KDB-X can be. You’ll find the refactored version of the code below.

You can read everything about functional selects on my dedicated blog post here

analytics:{[stock;range;columns]

chartColumns:`time`price`sma50`sma200`buy_SD_CIRCLE`buy_SD_SIZE`sell_SD_CIRCLE`sell_SD_SIZE;

tableColumns:`time`sym`action`buy`sell`price`volume`sma50`sma200;

c:();

if[columns=`tab;c:tableColumns];

if[columns=`chart;c:chartColumns];

?[;();0b;{x!x} c]

sublist[range;] `time xasc update buy_SD_CIRCLE:buy*signal,buy_SD_SIZE:10,sell_SD_CIRCLE:abs sell*signal,sell_SD_SIZE:10 from

update action:`sell`doNothing`buy 1+signal,buy:?[signal=1;price;0N],sell:?[-1=signal;price;0n] from

update signal:deltas 0<signum sma50-sma200 from

select time,sym,sma50:mavg[50;close],sma200:mavg[200;close],price:close,volume from stocks where sym=stock}

Now all that remains is a bit of clean-up to make the dashboard look polished and professional. Rename each component to something meaningful, add some spacing to the left and right of the charts, and tidy up the layout. And just like that, voilà, you’ve got a sleek, production-ready dashboard that supports your traders’ decision-making with clarity and style.

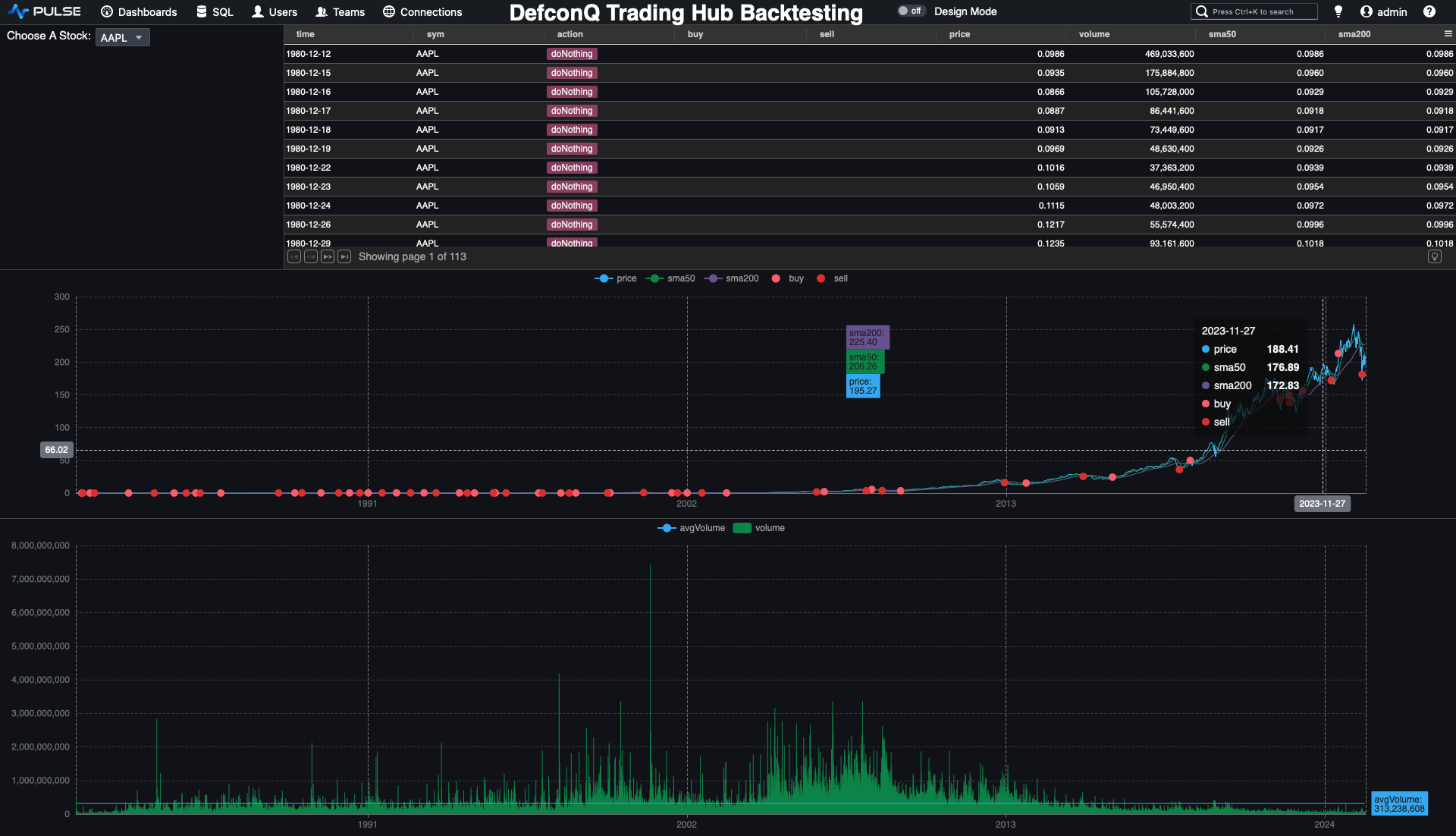

Backtesting for Alpha: Turning Strategy Into Performance

At the start of this tutorial, I promised we would build a backtesting engine for our trading strategy, and I always deliver. In this final section, we’ll put everything together by creating a simple yet powerful backtester, powered by KDB-X’s built-in timer functionality: .z.ts.

Normally, .z.ts is undefined, but once you assign a function to it, that function is executed automatically every n milliseconds. You control this interval via a system command \t, either when starting your process with -t n or dyhnamically at runtime with \t n.

Let’s look at a small example to understand how it works. We define .z.ts:{show x}, which prints the argument x every time the timer fires. By default, x is the current timestamp. So, when we set the timer to fire every 1000 milliseconds using \t 1000, we get the current time printed once per second. Simple, elegant, and exactly what we’ll use to “time-lapse” our historical data for backtesting. You can reseet the timer by setting it to zero \t 0

q).z.ts:{show x}

q)\t 1000

q)2025.12.07D15:23:23.316105000

2025.12.07D15:23:24.316105000

2025.12.07D15:23:25.316105000

2025.12.07D15:23:26.316105000

2025.12.07D15:23:27.316105000

2025.12.07D15:23:28.316105000

2025.12.07D15:23:29.316105000

2025.12.07D15:23:30.316105000

\t 0

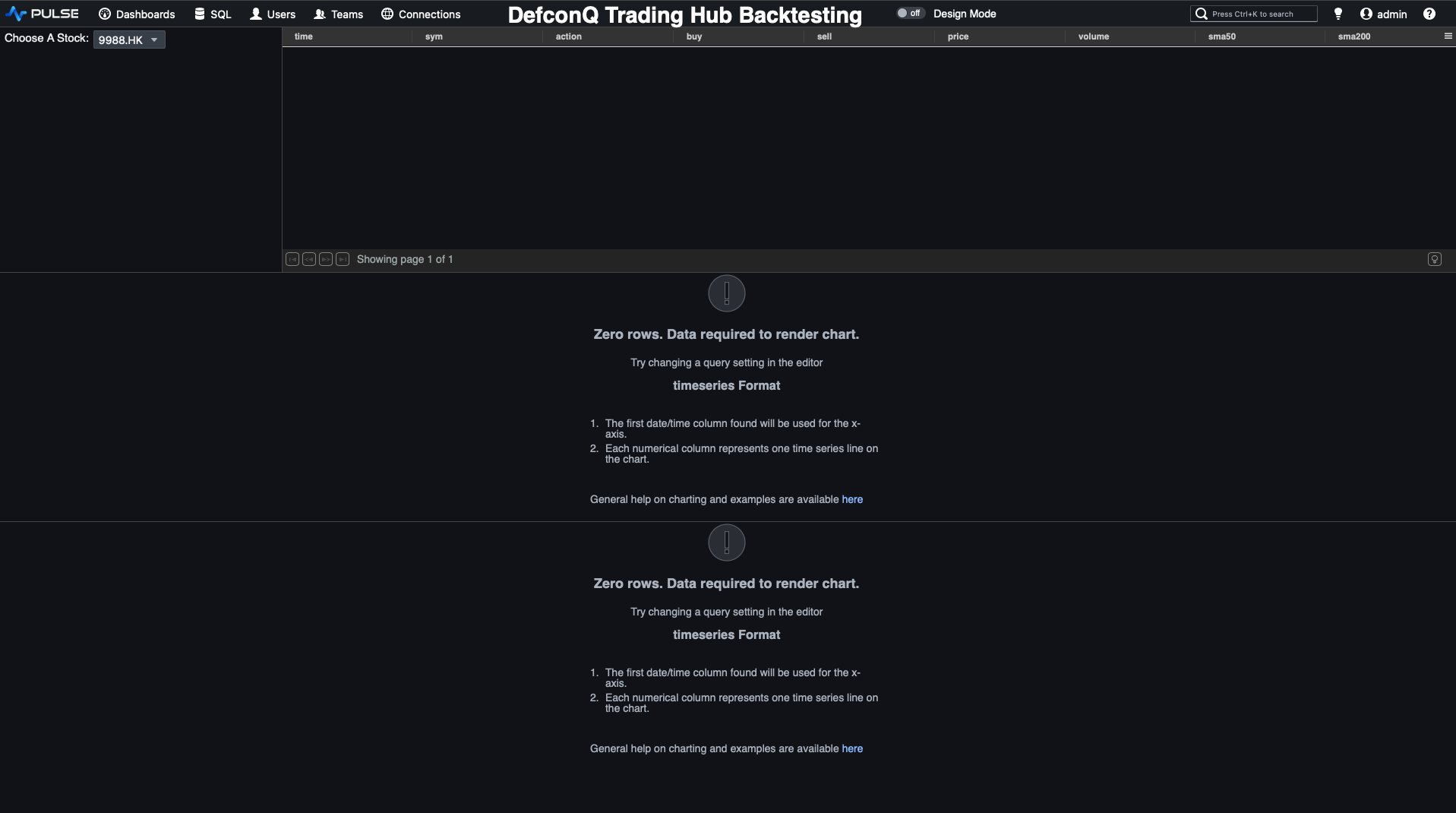

Remember, our original feed handler holds the entire price history for our stocks, about 75,000 records spanning from 1980 all the way to 2025. For the backtesting engine, we want to replay this history as a time-lapse, streaming one day’s worth of data every 100 milliseconds.

q)count data

75863

q)exec `startDate`EndDate!(min;max)@\:time by sym from data

| startDate EndDate

------ | -----------------------------------------------------------

7203.T | 1999.05.06D00:00:00.000000000 2025.05.26D00:00:00.000000000

9988.HK| 2019.11.26D00:00:00.000000000 2025.05.26D00:00:00.000000000

AAPL | 1980.12.12D00:00:00.000000000 2025.05.23D00:00:00.000000000

AMZN | 1997.05.15D00:00:00.000000000 2025.05.23D00:00:00.000000000

GOOG | 2004.08.19D00:00:00.000000000 2025.05.23D00:00:00.000000000

META | 2012.05.18D00:00:00.000000000 2025.05.23D00:00:00.000000000

MSFT | 1986.03.13D00:00:00.000000000 2025.05.23D00:00:00.000000000

QQQ | 1999.03.10D00:00:00.000000000 2025.05.23D00:00:00.000000000

SPY | 1993.01.29D00:00:00.000000000 2025.05.23D00:00:00.000000000

TSLA | 2010.06.29D00:00:00.000000000 2025.05.23D00:00:00.000000000

VOW3.DE| 1998.07.22D00:00:00.000000000 2025.05.26D00:00:00.000000000

VTI | 2001.06.15D00:00:00.000000000 2025.05.23D00:00:00.000000000

The logic is straightforward:

- Extract the list of all distinct trading dates from our dataset.

- Initialize a counter to track our current position within that date list.

- On each timer tick (every 100 ms), publish the data for the next date to the Tickerplant.

- Increment the counter so the following tick streams the next day in sequence.

Alright, time to bring it all together!

q)dateList:exec distinct `date$time from data

q)dateList

1999.05.06 1999.05.07 1999.05.10 1999.05.11 1999.05.12 1999.05.13 1999.05.14 1999.05.17 1999.05.18 1999.05.19 1999.05.20 1999.05.21 1999.05.24 1999.05.25 1999.05.26 1999.05.27 1999.05.28 1999.05.31 1999.06.01 1999.06.02 1999.06.03 1999.06...

q)(min;max)@\:dateList

1980.12.12 2025.05.26

q)cntr:0

q)select from data where $[`date;time]=dateList 0

time sym feedHandlerTime open high low close volume

---------------------------------------------------------------------------------------------------------------------

1999.05.06D00:00:00.000000000 7203.T 1999.05.06D00:00:00.000000000 396.8346 410.4793 392.2863 410.4793 15575000

1999.05.06D00:00:00.000000000 AAPL 1999.05.06D00:00:00.000000000 0.3498498 0.3521977 0.3305959 0.3343524 433148800

1999.05.06D00:00:00.000000000 AMZN 1999.05.06D00:00:00.000000000 3.7 3.775 3.39375 3.434375 365688000

1999.05.06D00:00:00.000000000 MSFT 1999.05.06D00:00:00.000000000 24.73093 24.86503 23.75395 23.88805 74021000

1999.05.06D00:00:00.000000000 QQQ 1999.05.06D00:00:00.000000000 45.50791 45.90524 43.83911 44.26293 15173400

1999.05.06D00:00:00.000000000 SPY 1999.05.06D00:00:00.000000000 84.72099 85.15424 83.42122 84.43543 13507200

1999.05.06D00:00:00.000000000 VOW3.DE 1999.05.06D00:00:00.000000000 12.69323 12.72496 12.17915 12.50283 107812

q)stream:{-1"Streaming data for date:",string dateList cntr;select from data where $[`date;time]=dateList cntr;cntr::cntr+1}

q)stream[]

Streaming data for date:1999.05.10

q)stream[]

Streaming data for date:1999.05.11

q)stream[]

// Add the actual publishing

stream:{-1"Streaming data for date:",string dateList cntr;h(`.u.upd;`stocks;select from data where $[`date;time]=dateList cntr);cntr::cntr+1}

Before we begin streaming, let’s reset the CEP by clearing out any previously stored data and create a copy of our Pulse dashboard to preserve the historical version. In the new Backtesting Dashboard, we’ll remove the date-range drop-down and adjust our functions accordingly. With these two changes in place, we’re ready to fire up the backtesting engine. It's showtime!!!

Video Tutorial

Code repo: Pulse Powered Alpha: Building your First Trading Strategy with KDB-X and Pulse